Brilliant Strategies Of Tips About Tds Reconciliation Format In Excel

Key features technology enabled form 26as reconciliation for multiple years automatic identification of tds deducted on gst component which improves working capital.

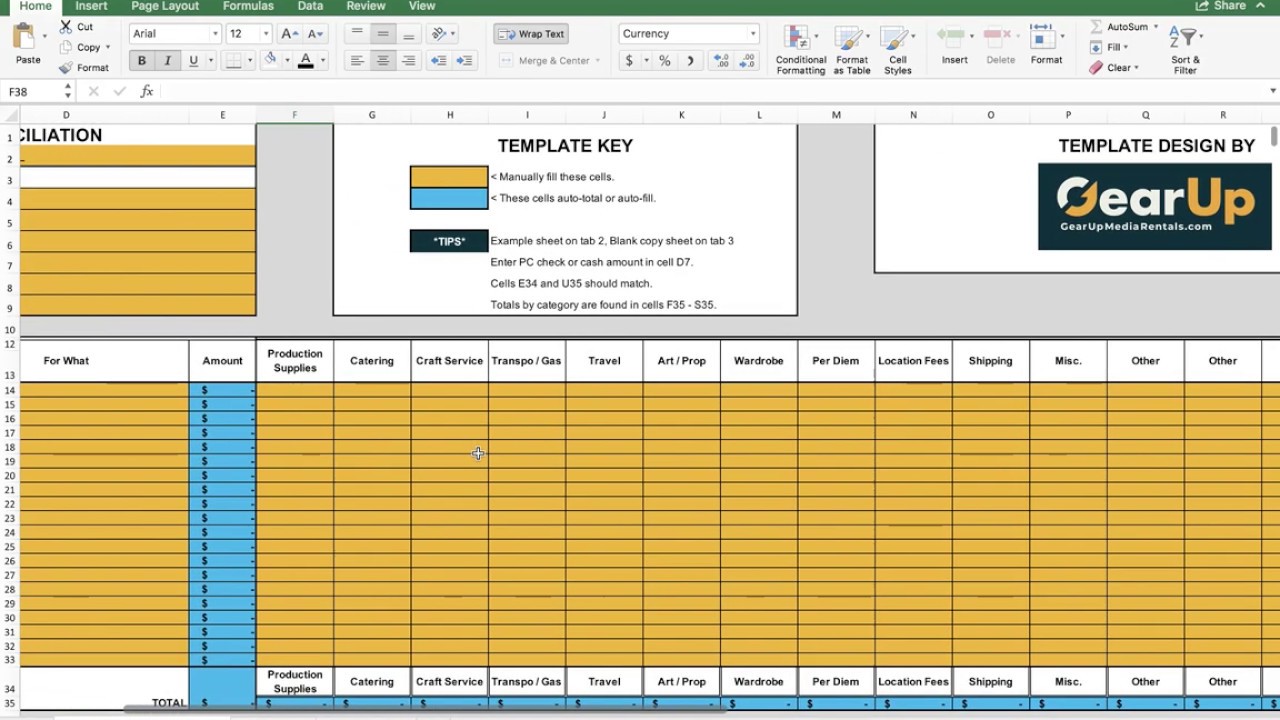

Tds reconciliation format in excel. Other files by the user. How to prepare tds return for salary person in excel | how to file tds return for salary person how to prepare tds return in excel format for tds return. Automate your tds reconciliation.

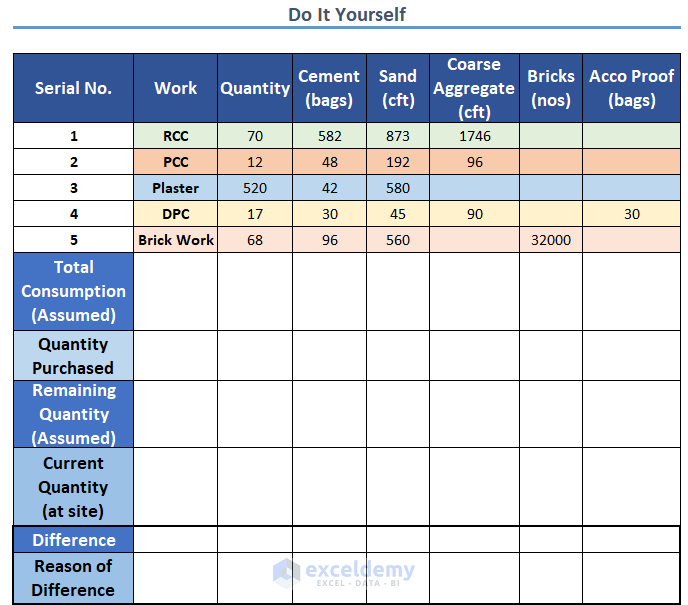

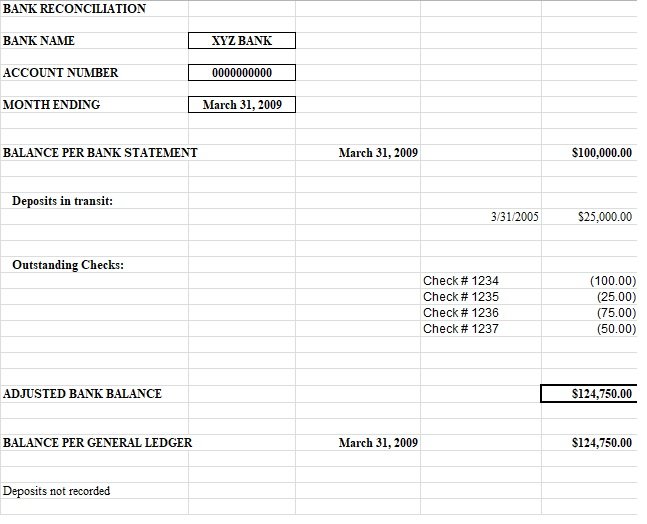

How to prepare tds return in excel format for tds return filing | prepare tds return in excel tds rate chart turnover limit for tds return filing and tds. How to prepare a tds reconciliation format in excel? Convert and reconcile your raw data file into 26as format in microsoft excel with a single click.

For any query or question contact me on [email protected] & you can also contact me for any other topic.thank you🙏💕 for watchingplease share wi. To do so, first, go to c8 and. Tds forms in excel / fillable pdf formats with formulas tds calculator | tds rates the forms compiled by karvitt.com in fillable pdf and excel formats can be.

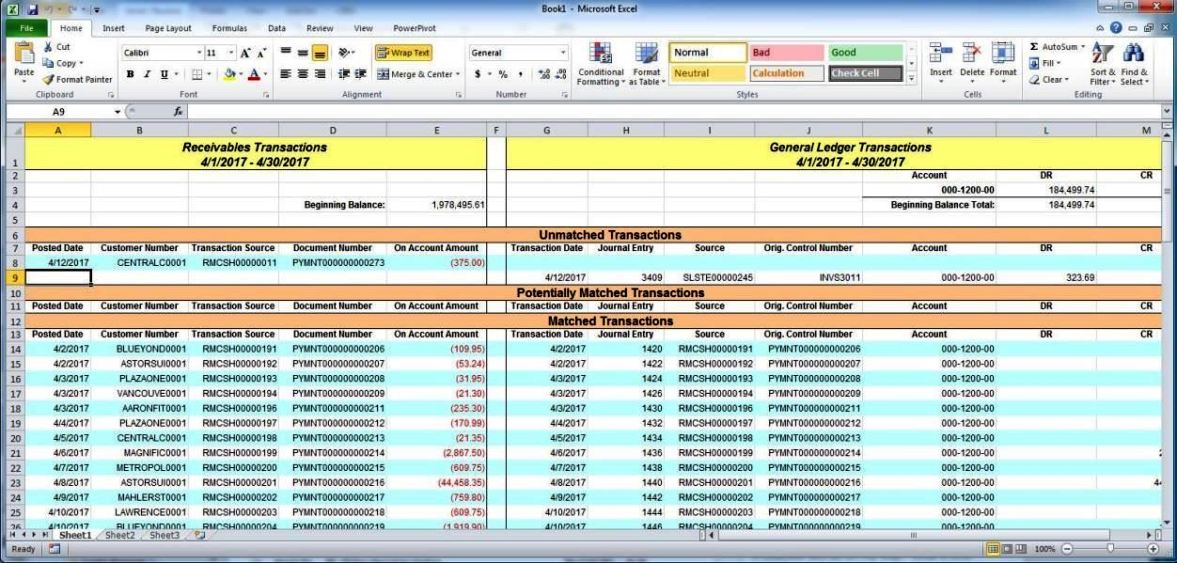

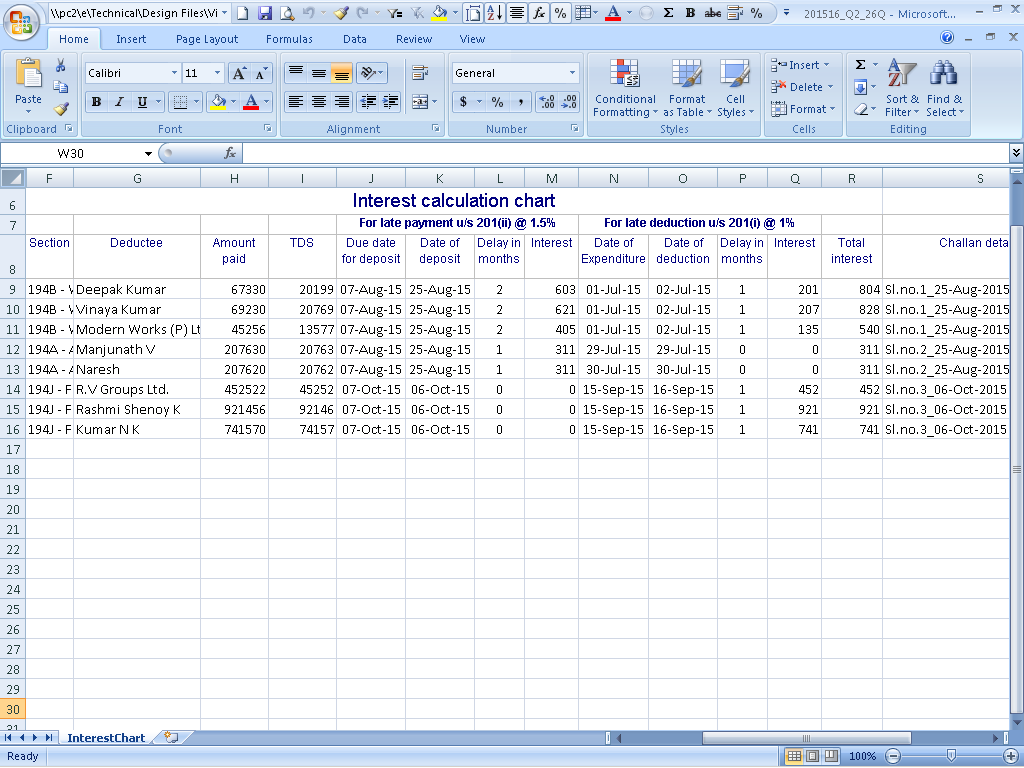

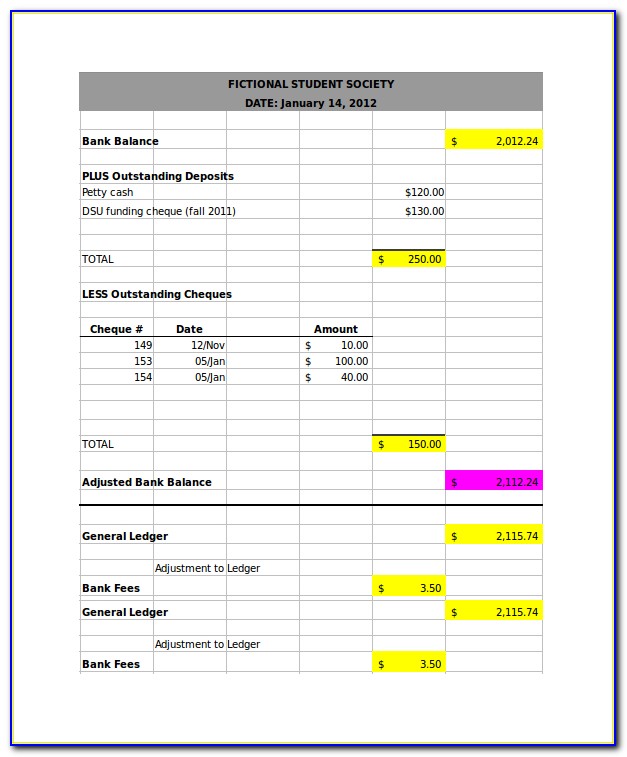

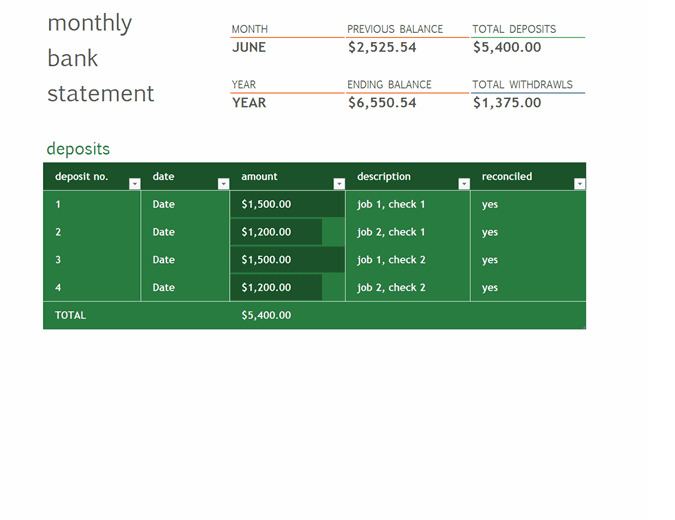

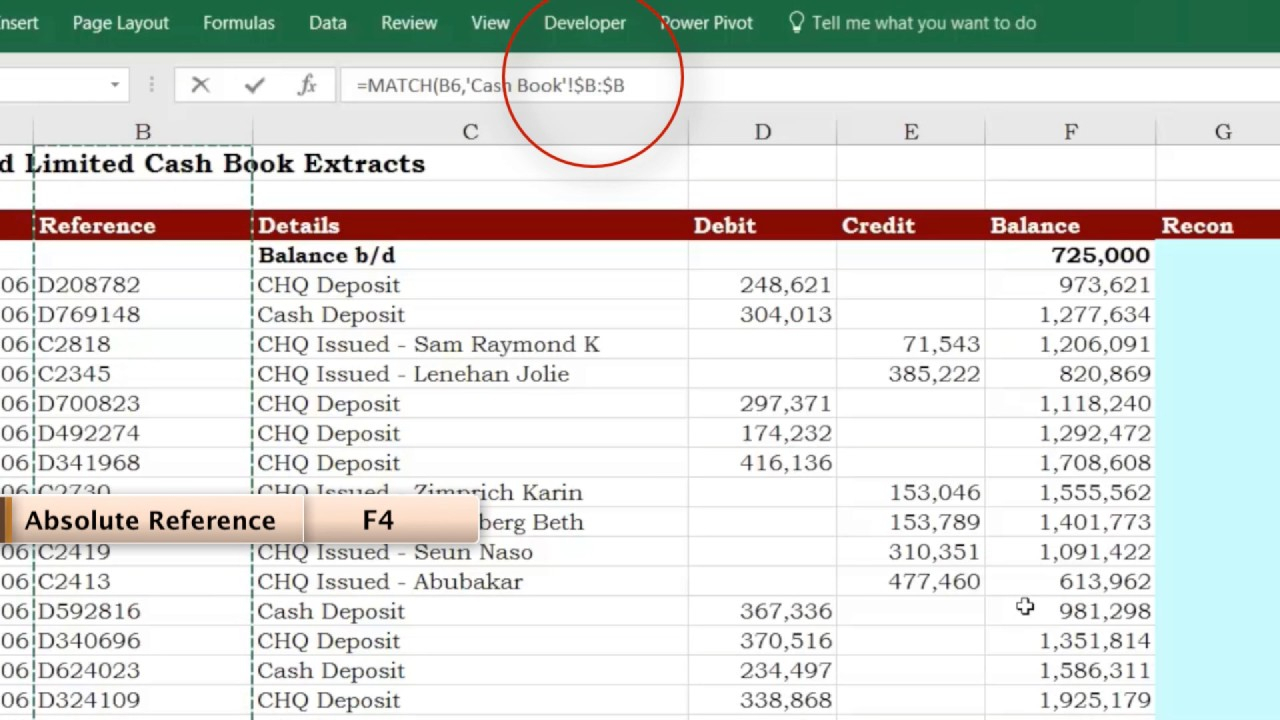

When you match your or reconcile your tds deduction calculation with 26as (form in which the tds deduction appears) it is called a tds reconciliation. Finding the duplicates firstly, create an additional column named duplicate check as shown in the following picture. Following that, enter the following.

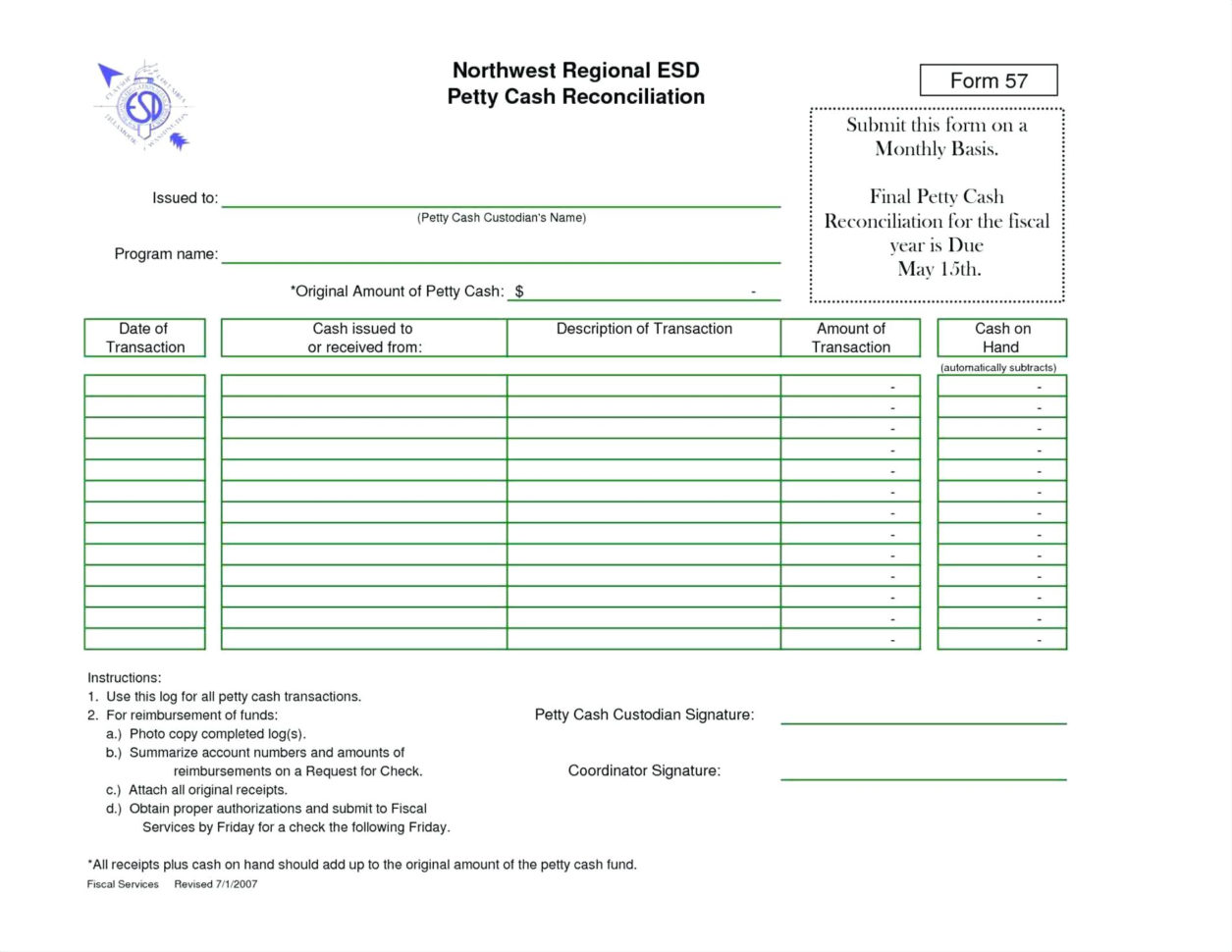

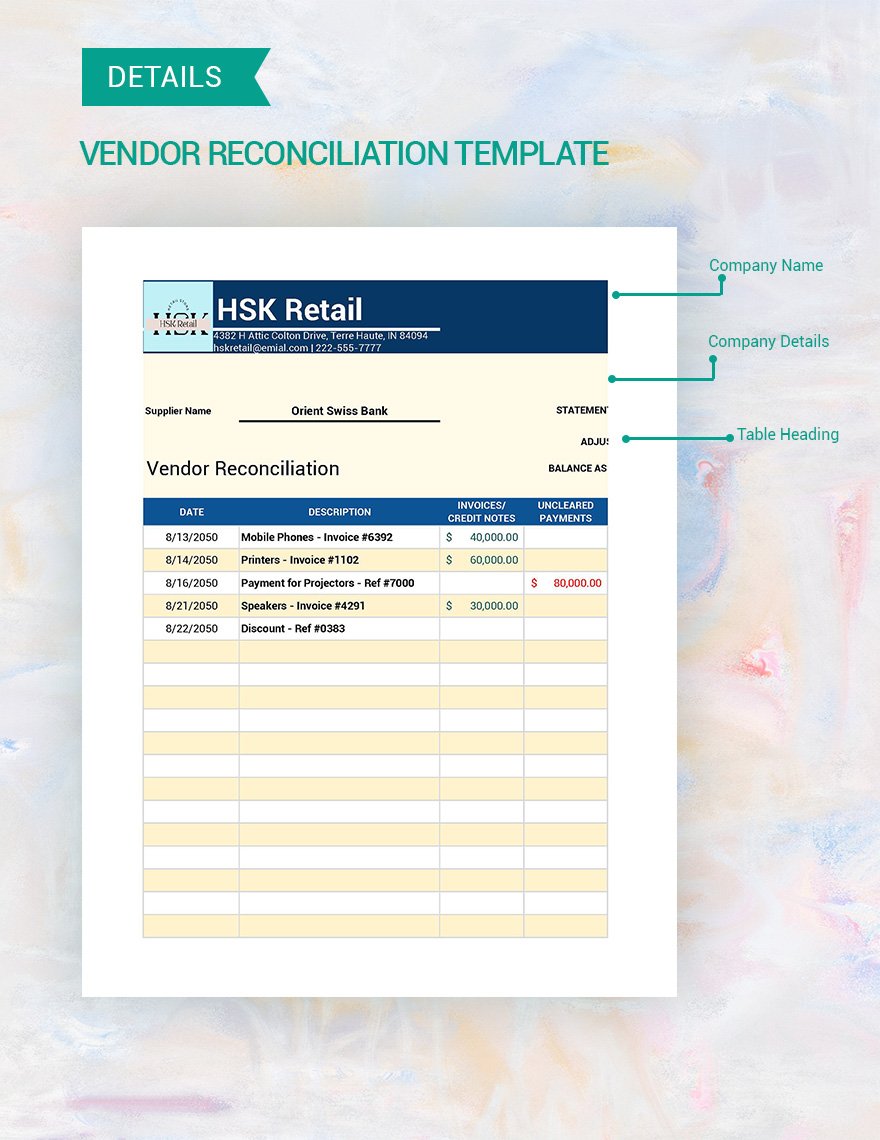

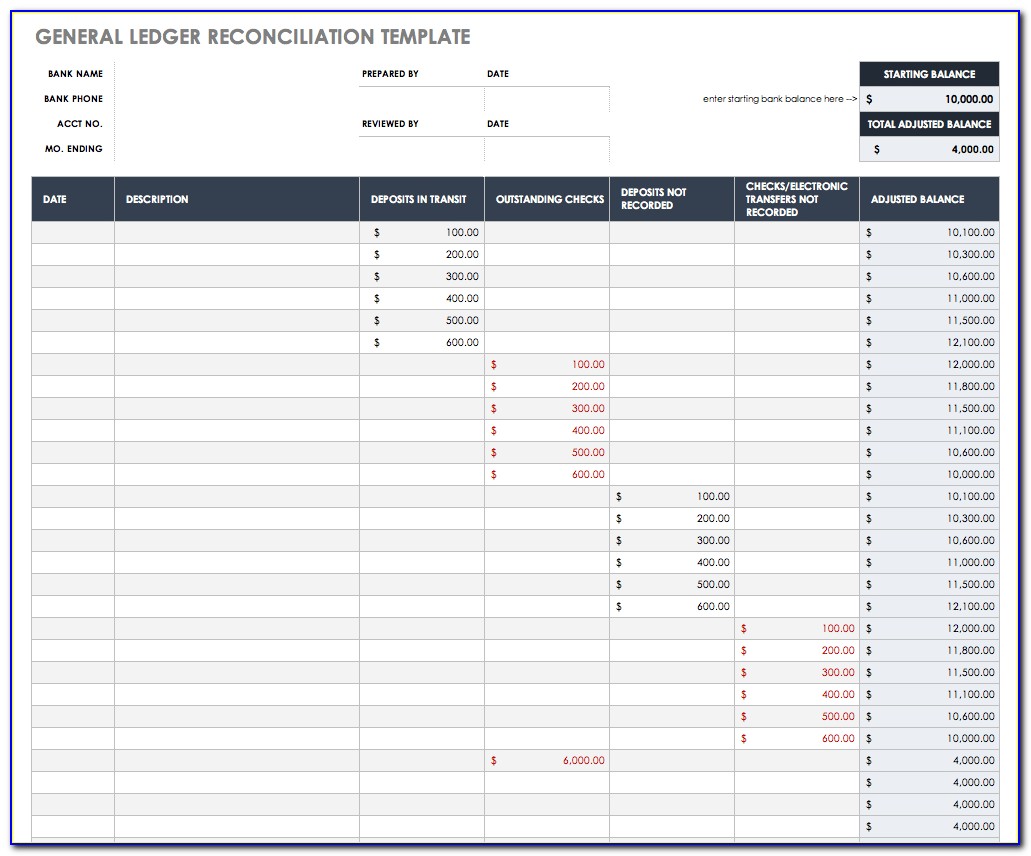

How to do tds reconciliation. Gst reconciliation tool in excel format. User of the sheet have to fill the.

Now, i will calculate the annual salary. The tds reconciliation format is used to match the required details of tax deducted at source (tds) taken out by the deductor with the tds reported by the deductee. Tds data needs to be provided in structured excel format.

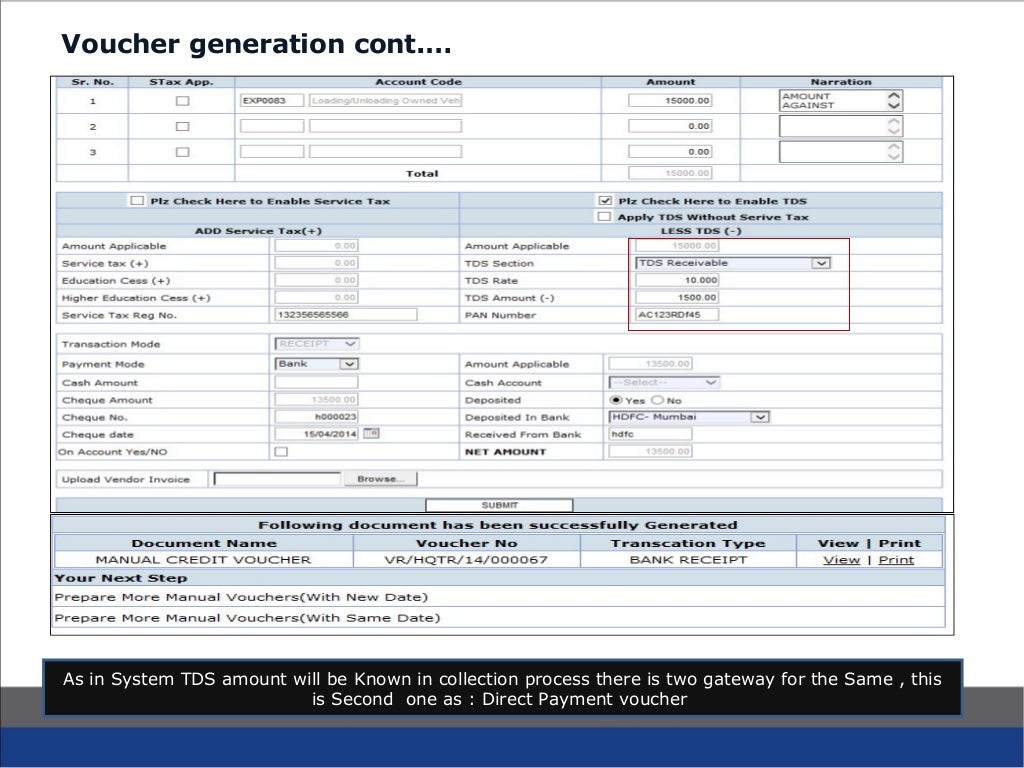

Tds working in excel. Gather all pertinent tds data, such as tds certificates that have been received, tds that has. With regard to processing tds returns that include interest requests, this article intends to make.

Calculate yearly salary let’s assume that the monthly salary of a person is rs 70,000. I have made an attempt to make gst reconciliation simple and easy to find mistakes.