Outrageous Tips About Variable Costing Income Statement Excel Template

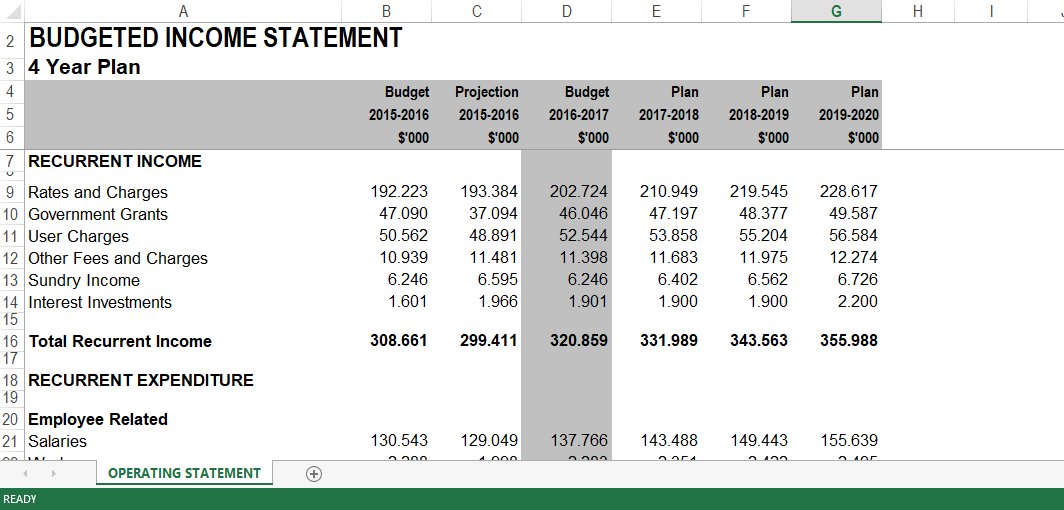

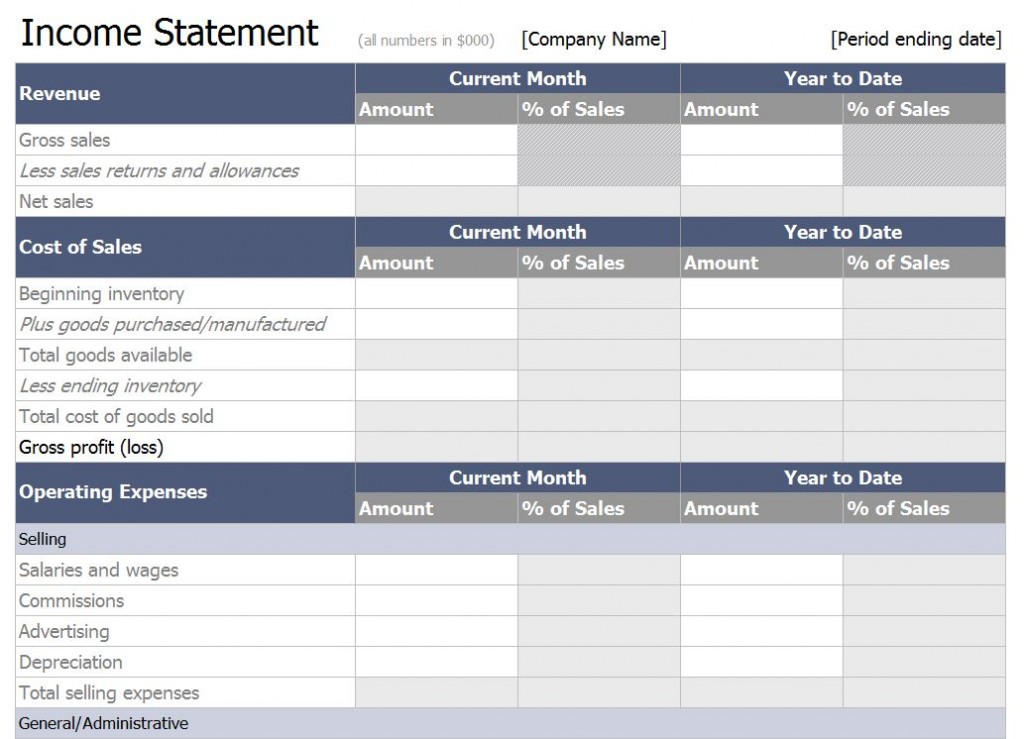

25+ income statement template excel (free download) in finance templates an income statement is an important financial document that provides businesses and organizations with a concise overview of their revenue and expenses over a.

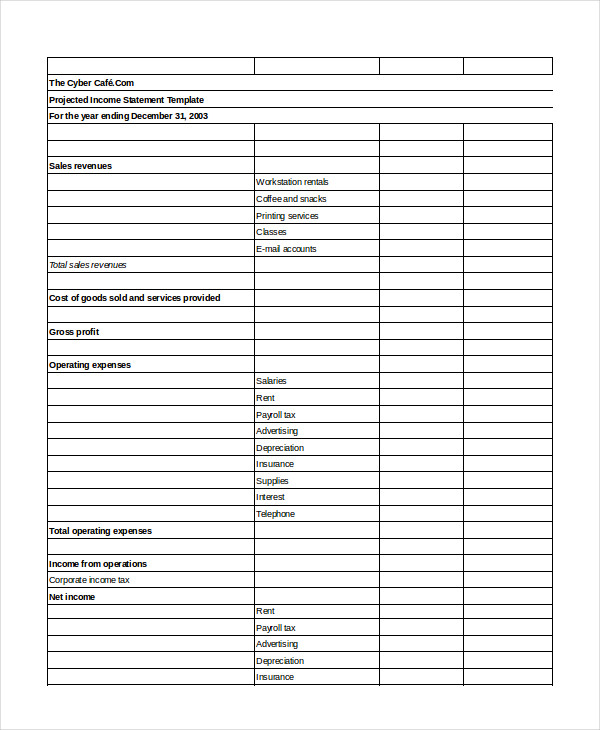

Variable costing income statement excel template. Other overhead expenses are deducted from the. They come in 3 different versions: All manufacturing expenses are considered part of product costs.

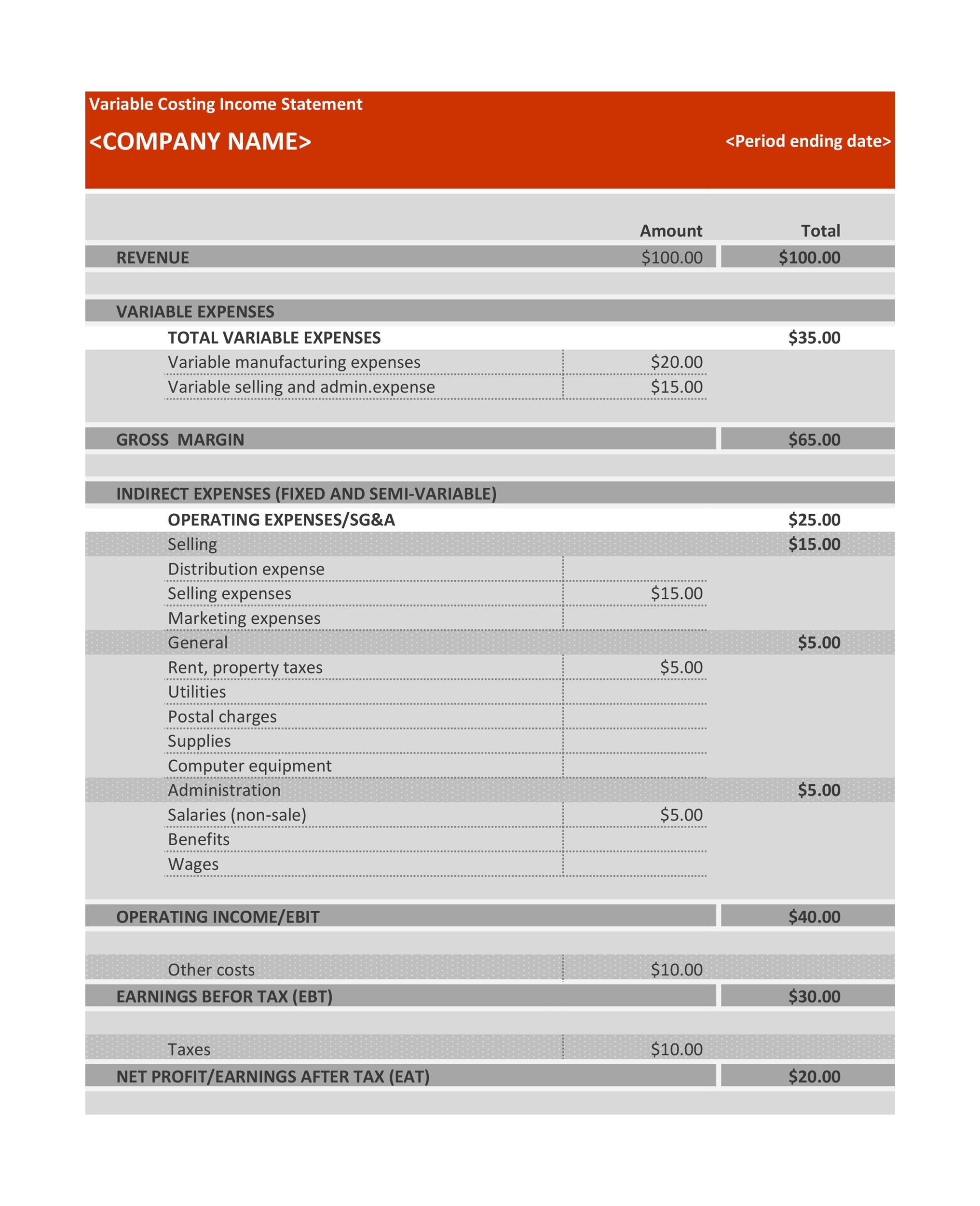

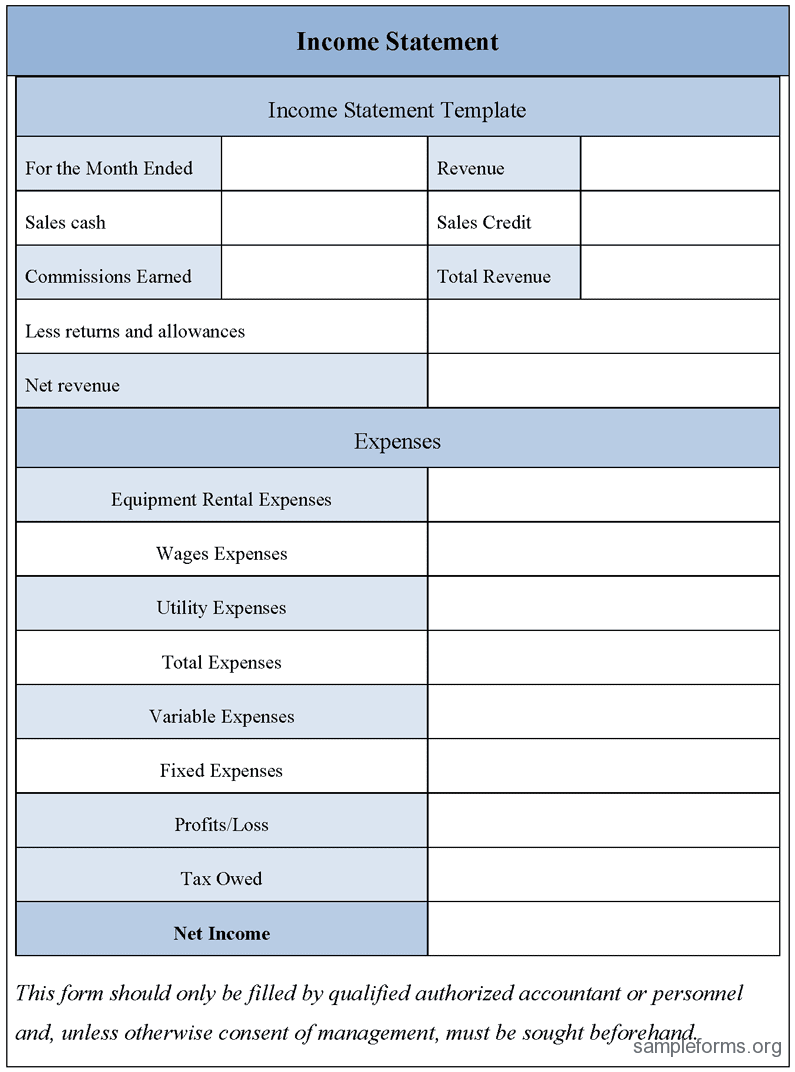

Track your costs in the customizable expenses column, and enter your revenue and expenses to determine your net income. The contribution margin is the incremental profit earned when a product's sales exceed its variable costs. Download an income statement template for microsoft excel® | updated 5/11/2020 an income statement or profit and loss statement is an essential financial statement where the key value reported is known as net income.

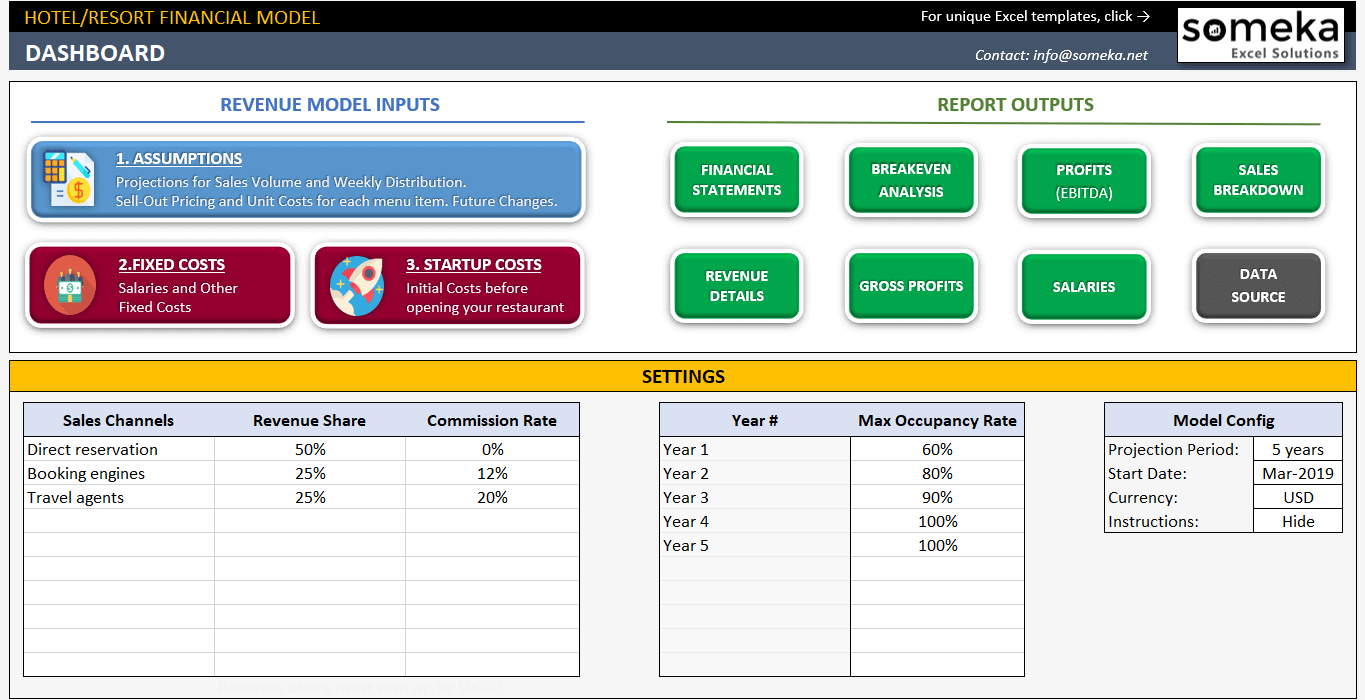

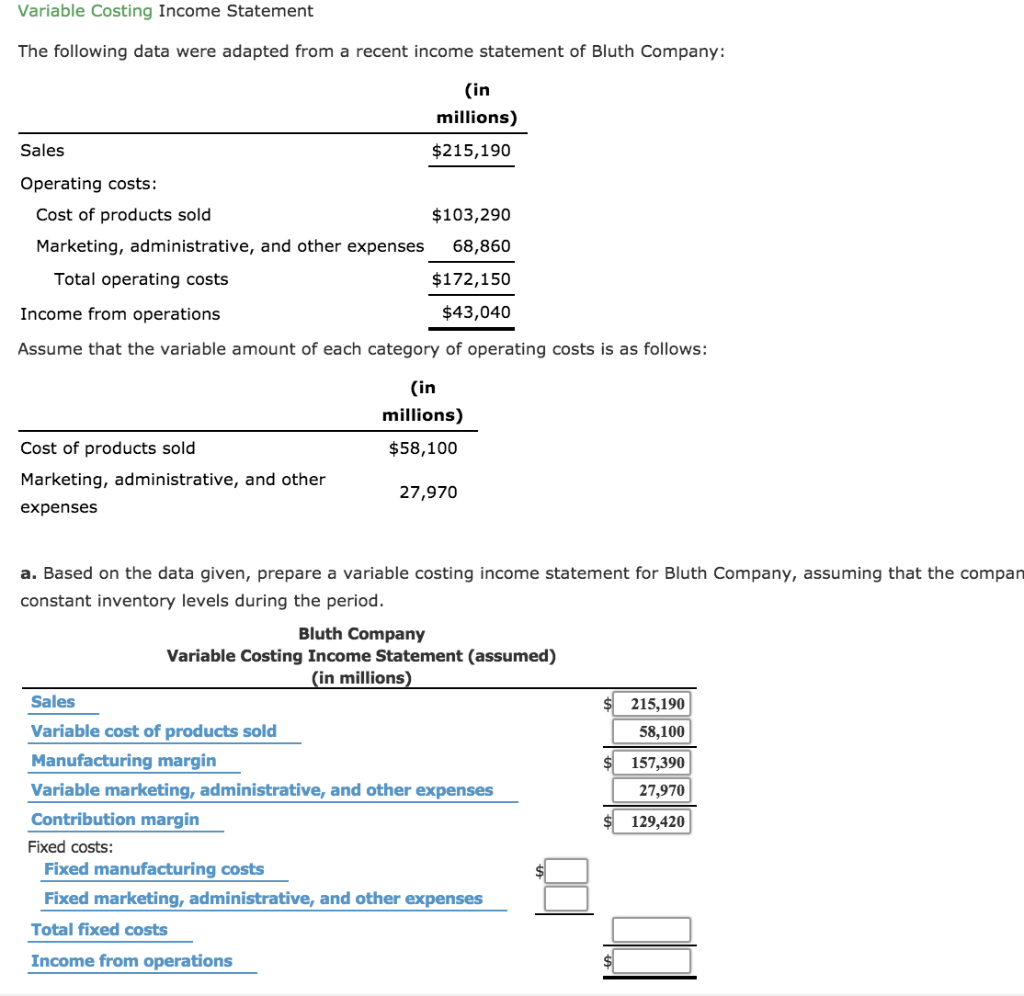

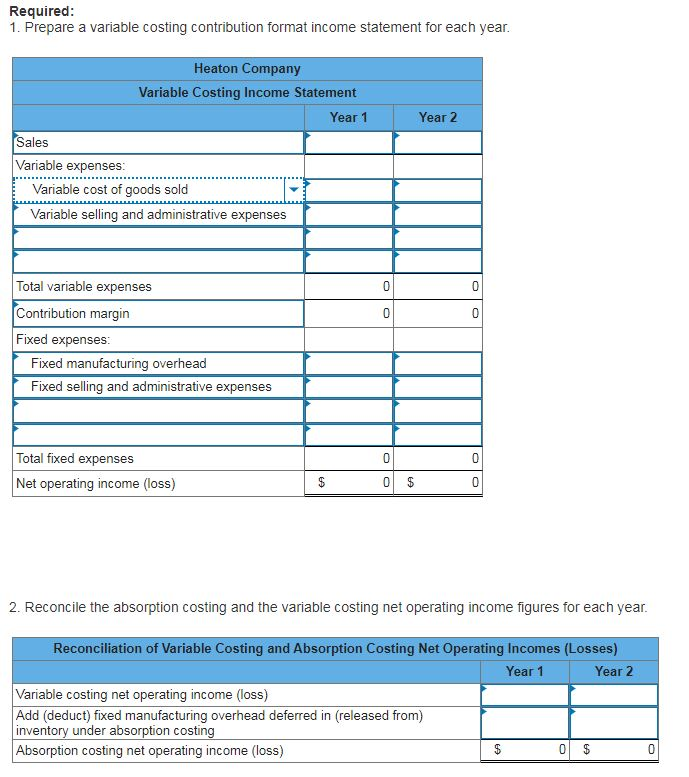

The method contrasts with absorption costing, in which the fixed manufacturing overhead is allocated to products produced. Microsoft excel | google sheets. What is a variable costing income statement?

A profit and loss (p&l) statement excel template is a spreadsheet that helps businesses analyze their financial performance and make informed decisions. Use these templates to add in pie charts and bar graphs so that you can visualize how your finances change over time. Examples variable costing vs absorption costing recommended articles:

Take a look at what they offer below. Download the free cvp analysis template Key takeaways variable costing is a financial metric used to understand production costs using only variable costs.

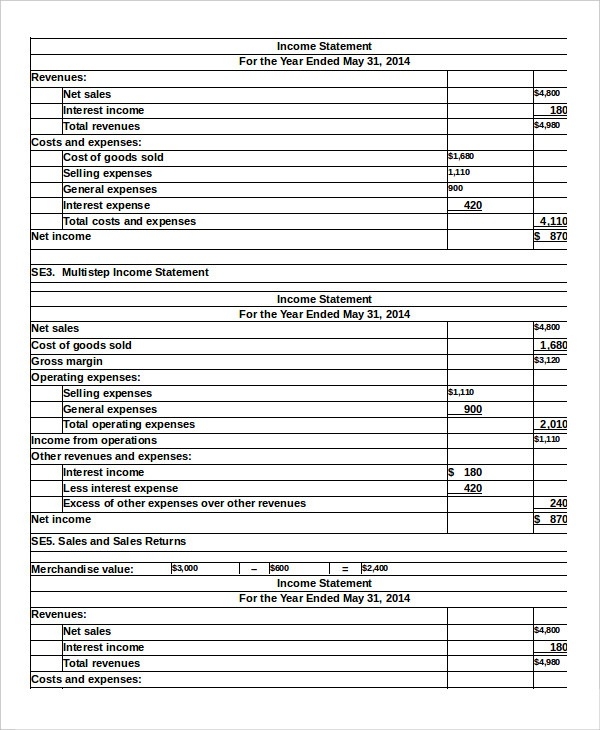

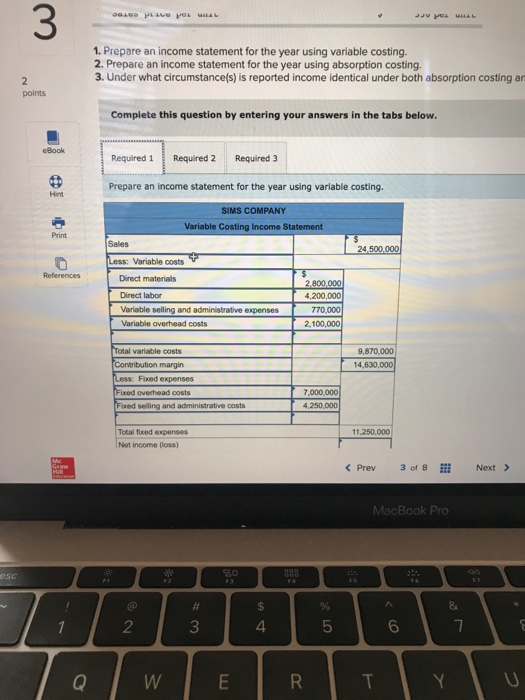

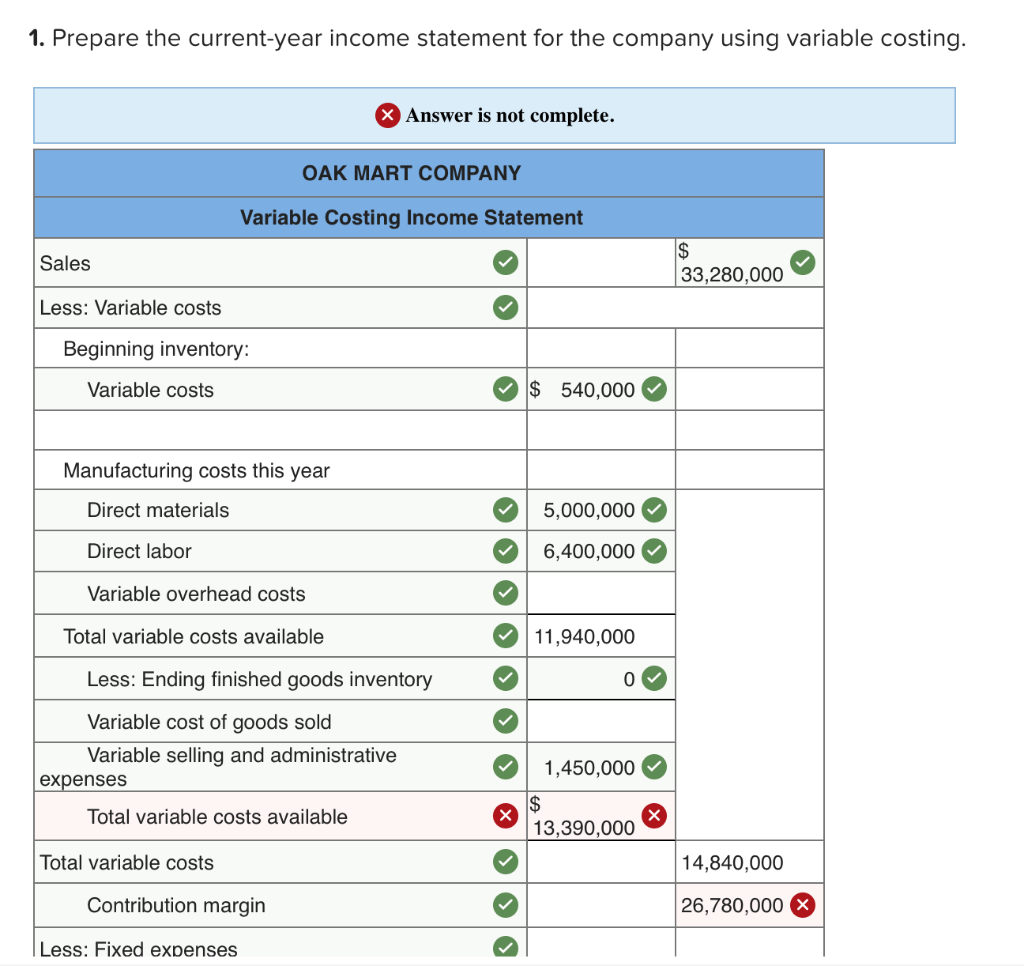

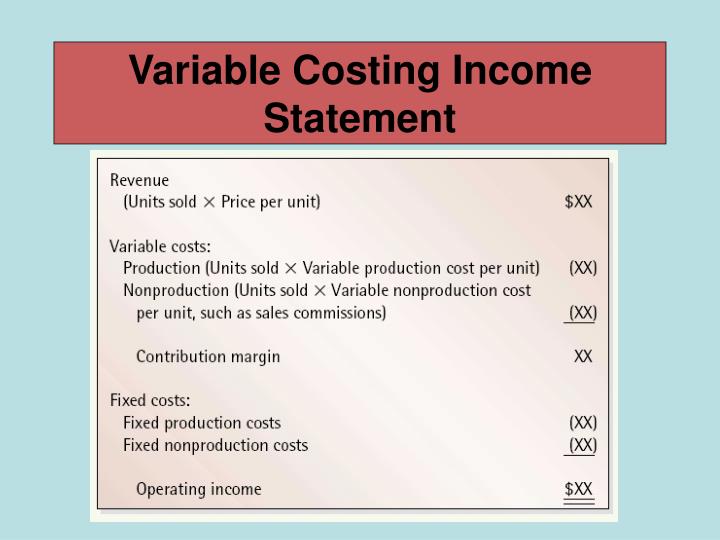

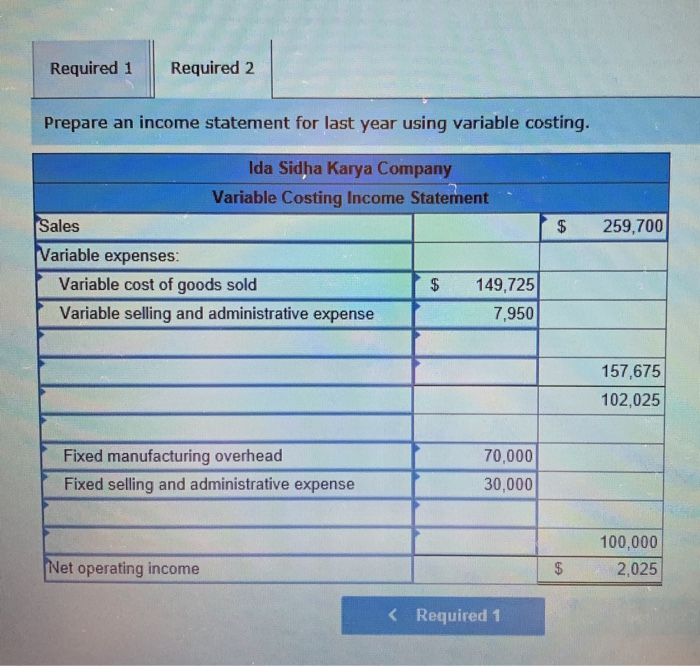

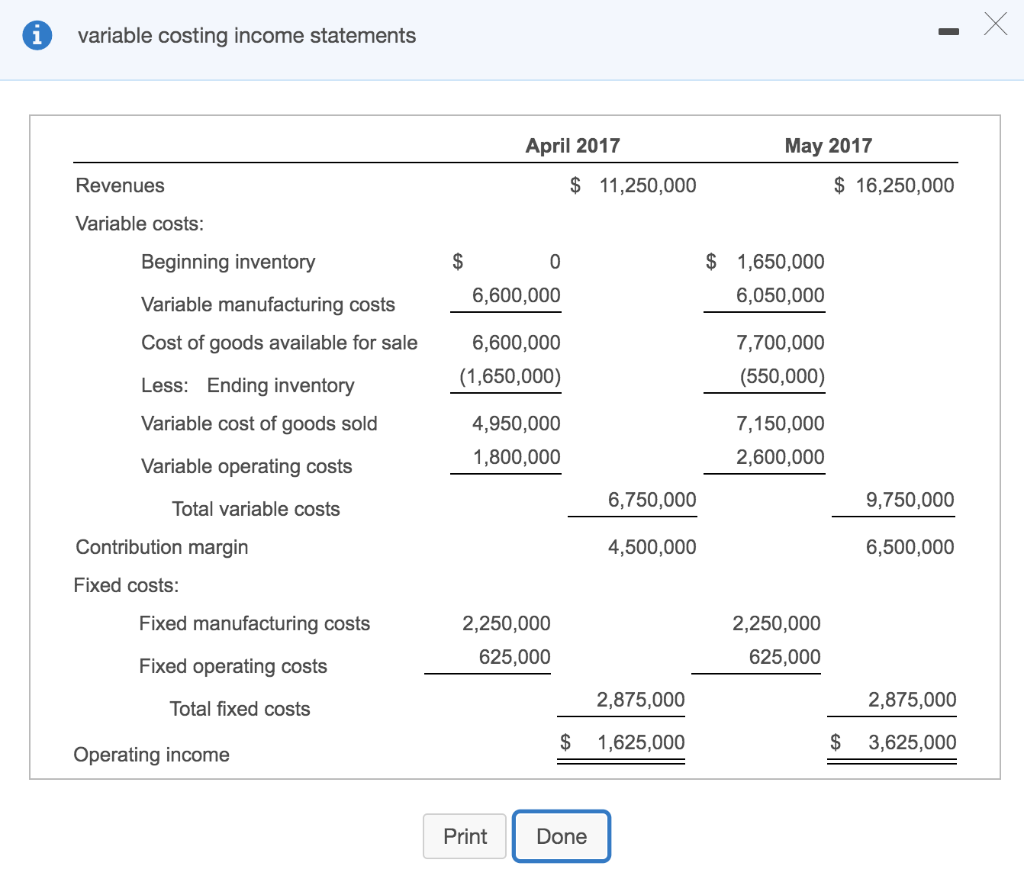

The income statement formula for variable costing subtracts all variable costs from revenue to get the contribution margin. Revenue is also known as sales on the income statement. The usual variable costs included in the calculation are labor and materials, plus the estimated increases in fixed costs (if any), such as administration, overhead, and selling expenses.

The marginal cost formula can be used in financial modeling to optimize the generation of cash flow. Then, we must subtract all fixed costs from the contribution margin to calculate the net profit or loss. Download the p&l statement excel template for free.

Variable costs the following table shows various costs incurred by a manufacturing company: Download the business case excel template for free. Revenue is the money generated from normal business operations, you can calculate as the average sales price times the number of units sold.

Example 2 let’s say that xyz company manufactures automobiles and it costs the company $250 to make one steering wheel. When to use a variable costing income. It is the top line (or gross income) figure from which costs are reduce to determine net income.

A variable costing income statement is a financial report in which you subtract the variable expenses from revenue, resulting in a contribution margin. Create infographics that show what categories are included in your budget and the types of factors that incorporate each category. The income statement (also called a profit and loss statement) summarizes a business’ revenues and operating expenses over a time period to calculate the net income for the period.