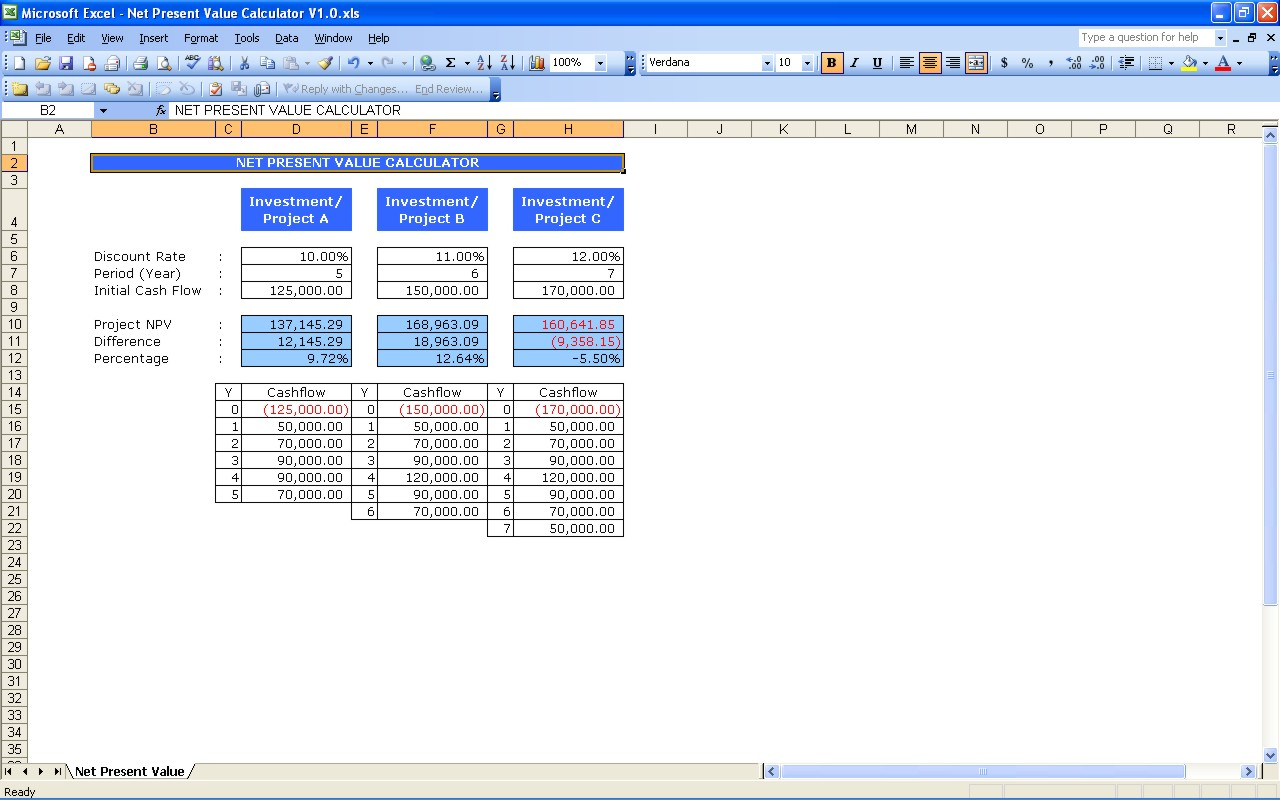

Outrageous Info About Npv Template Spreadsheet

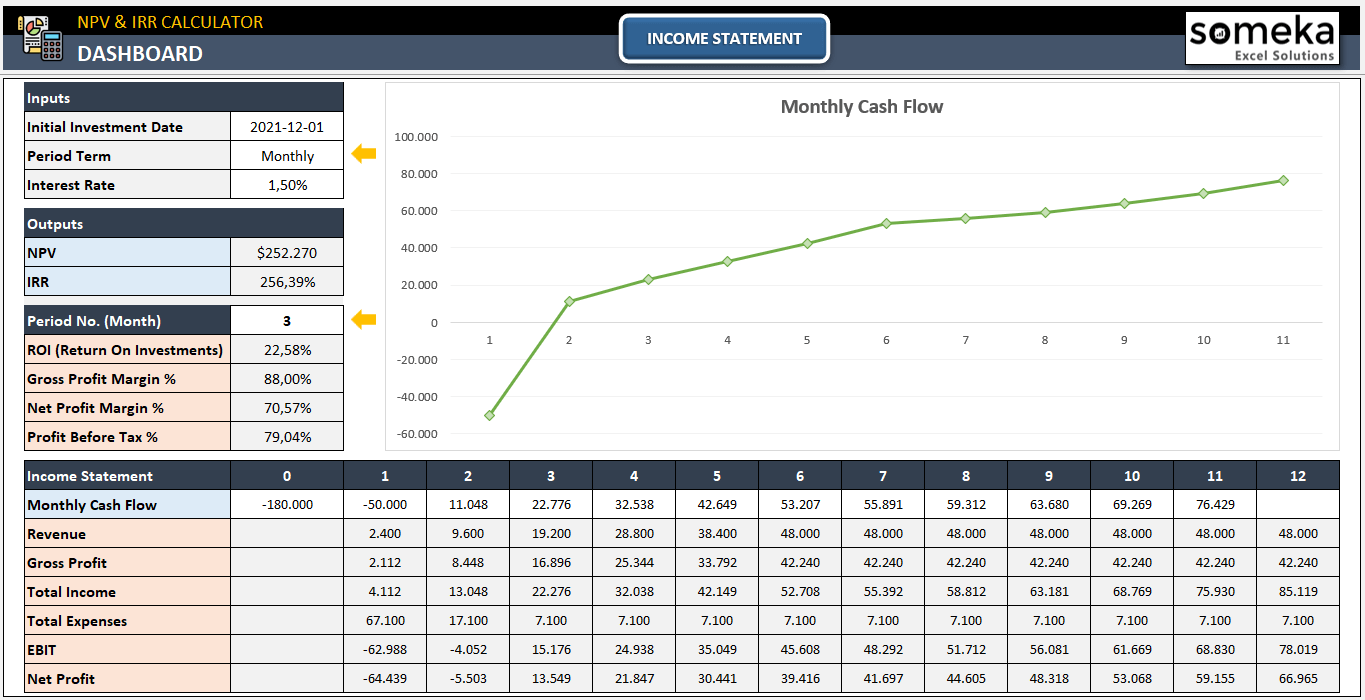

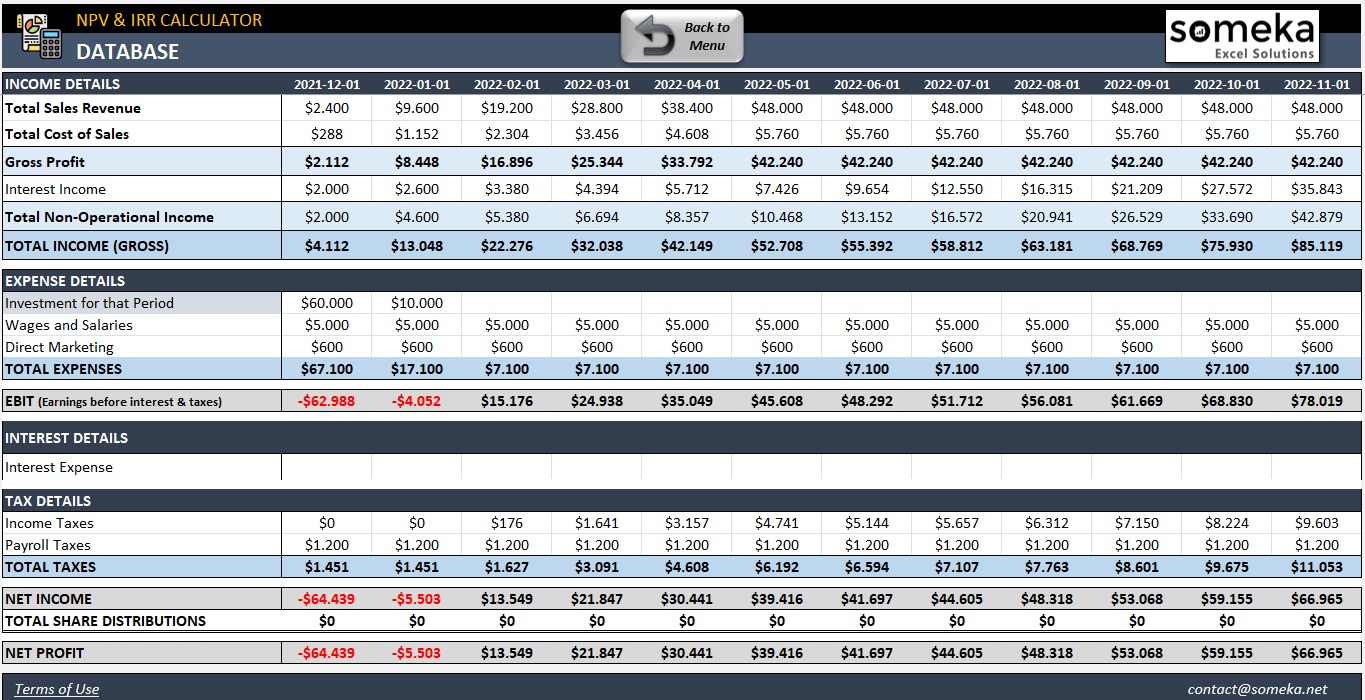

Download npv and xirr calculator excel template.

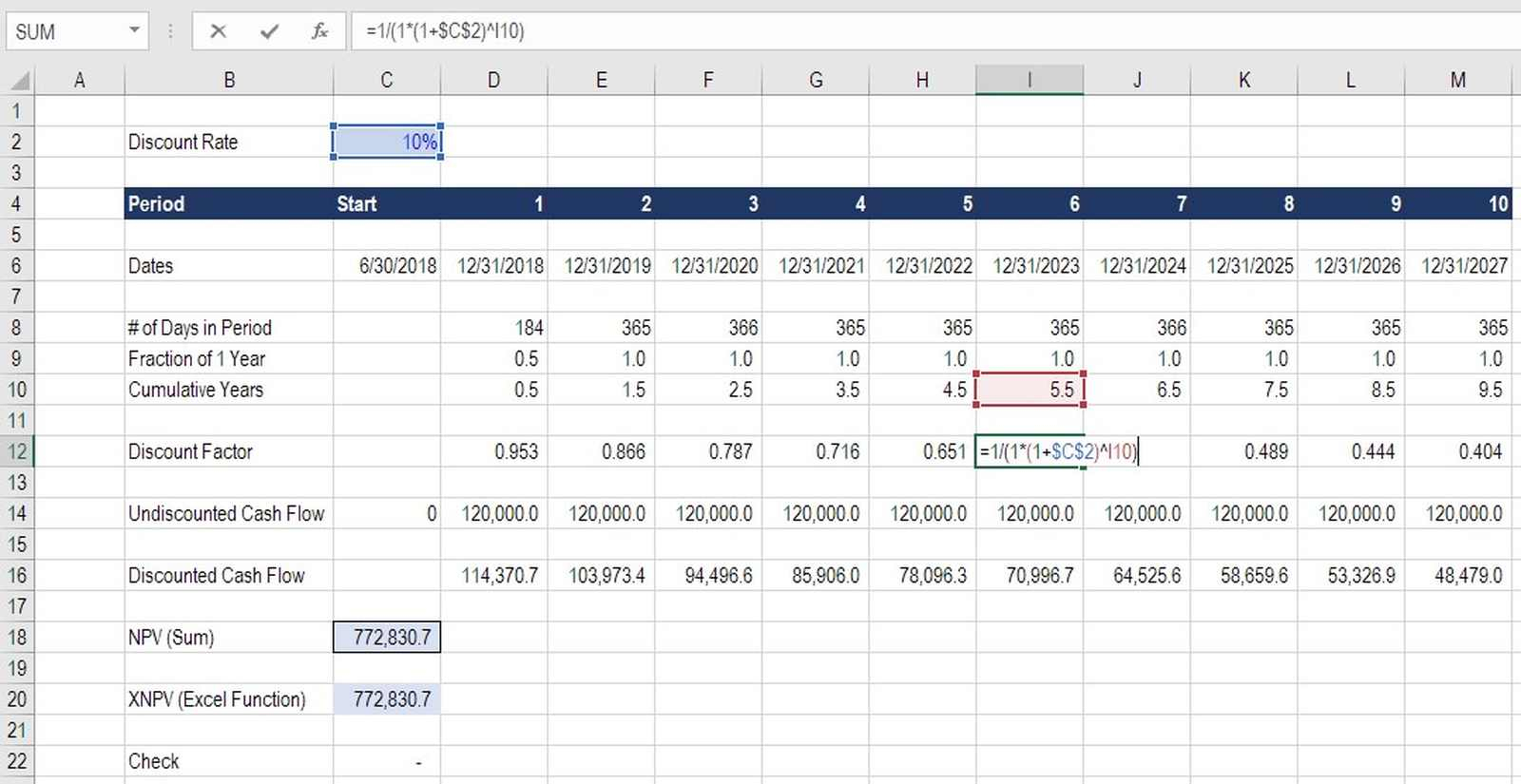

Npv template spreadsheet. You can use this npv calculator in the worksheet to do your own net present. Z 2 = cash flow in time 2; Product info video comments other templates template description one of the methods of doing a feasibility study.

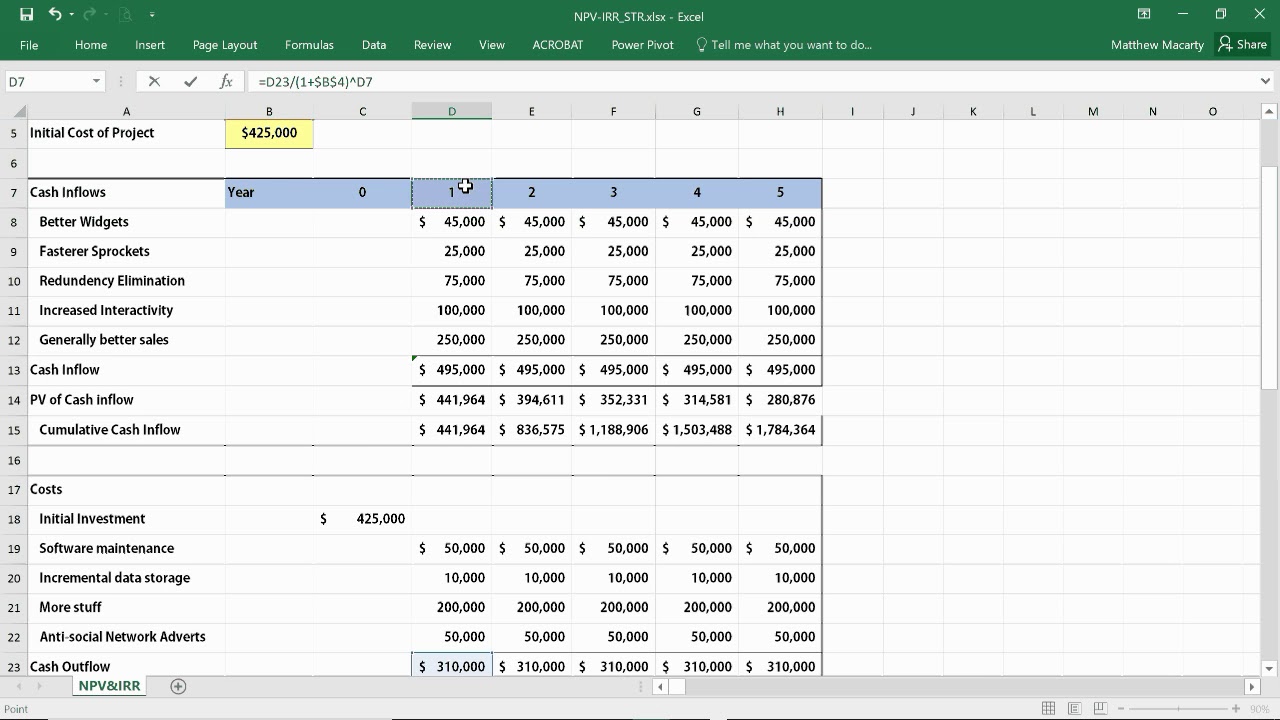

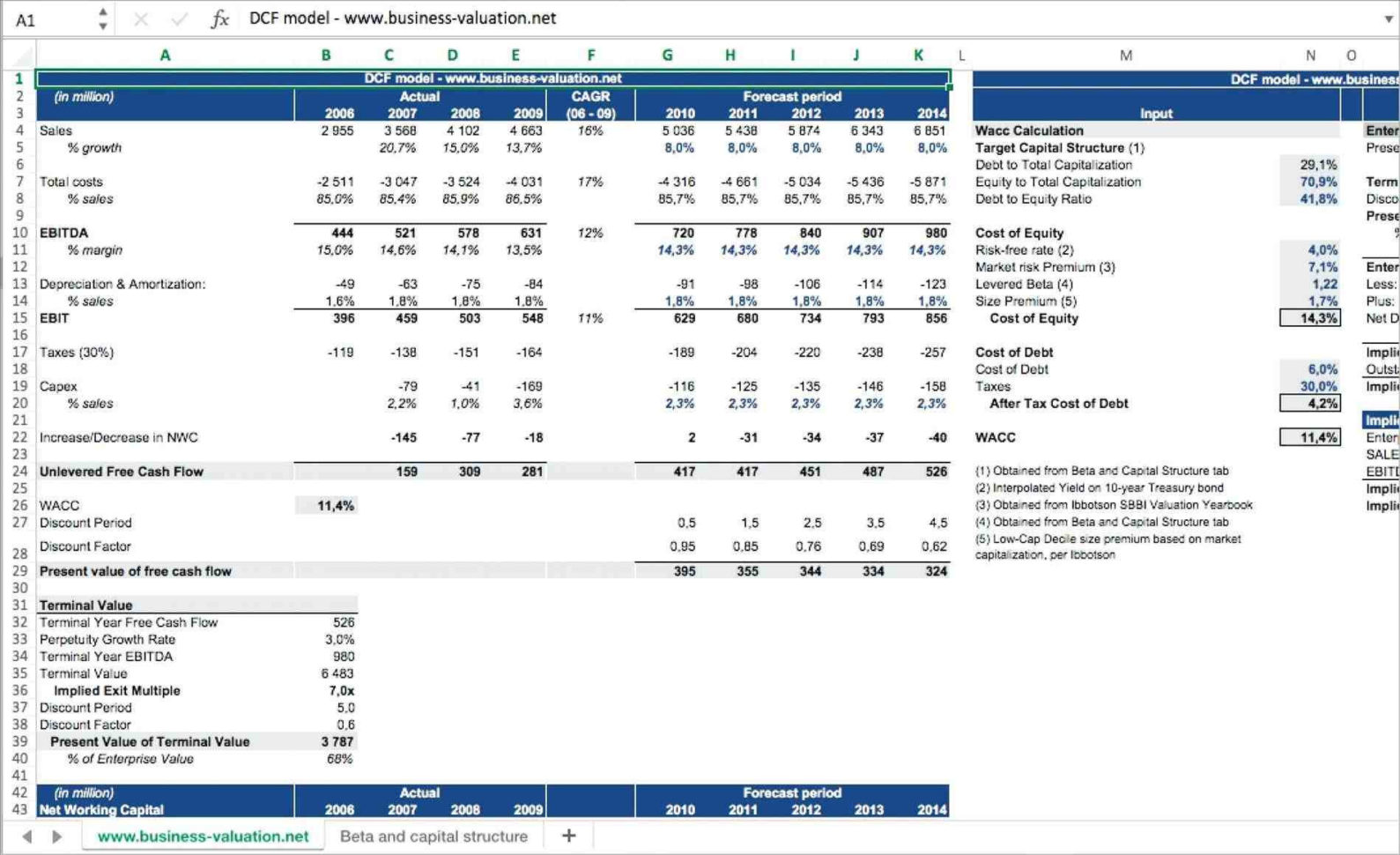

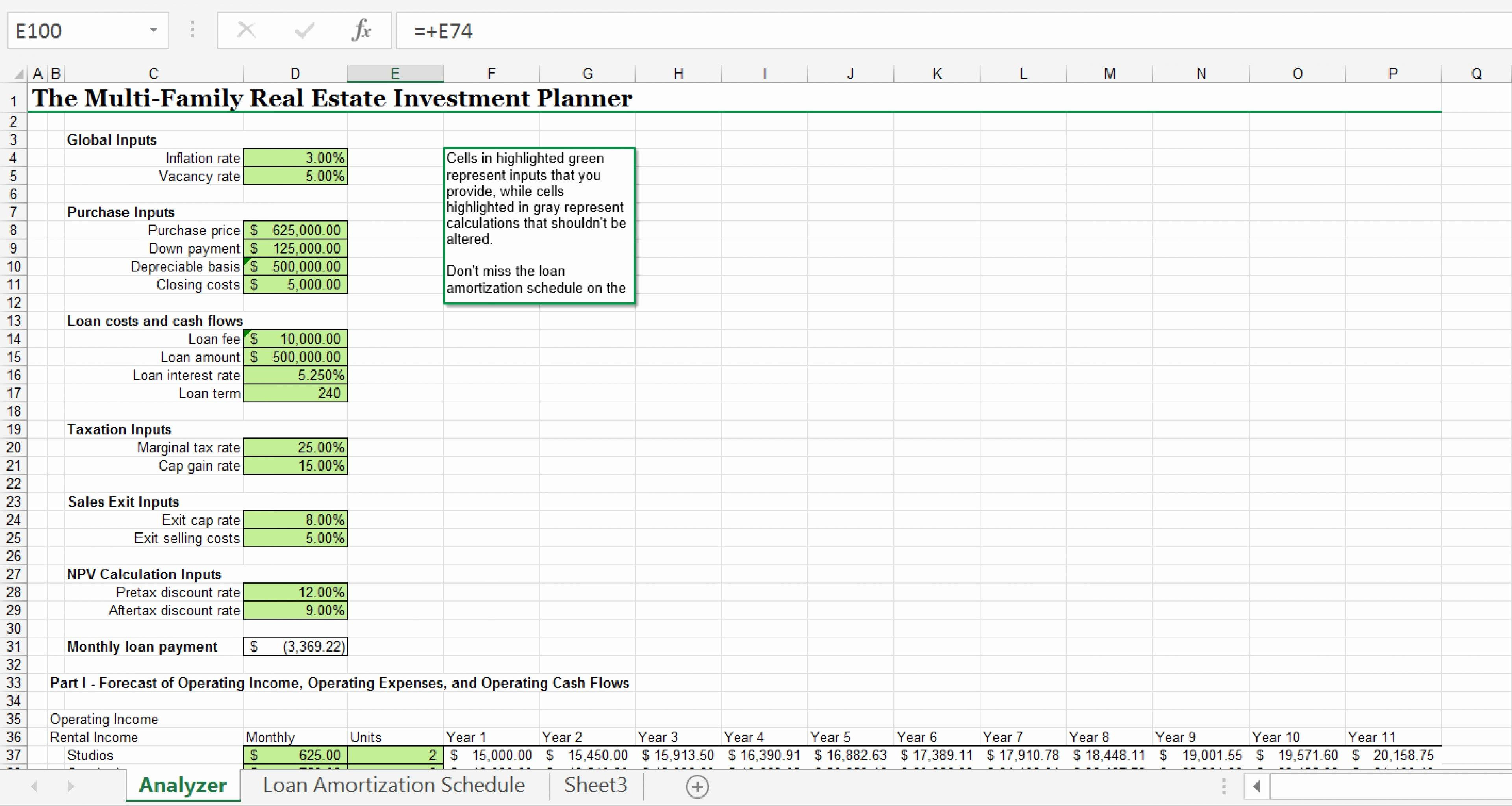

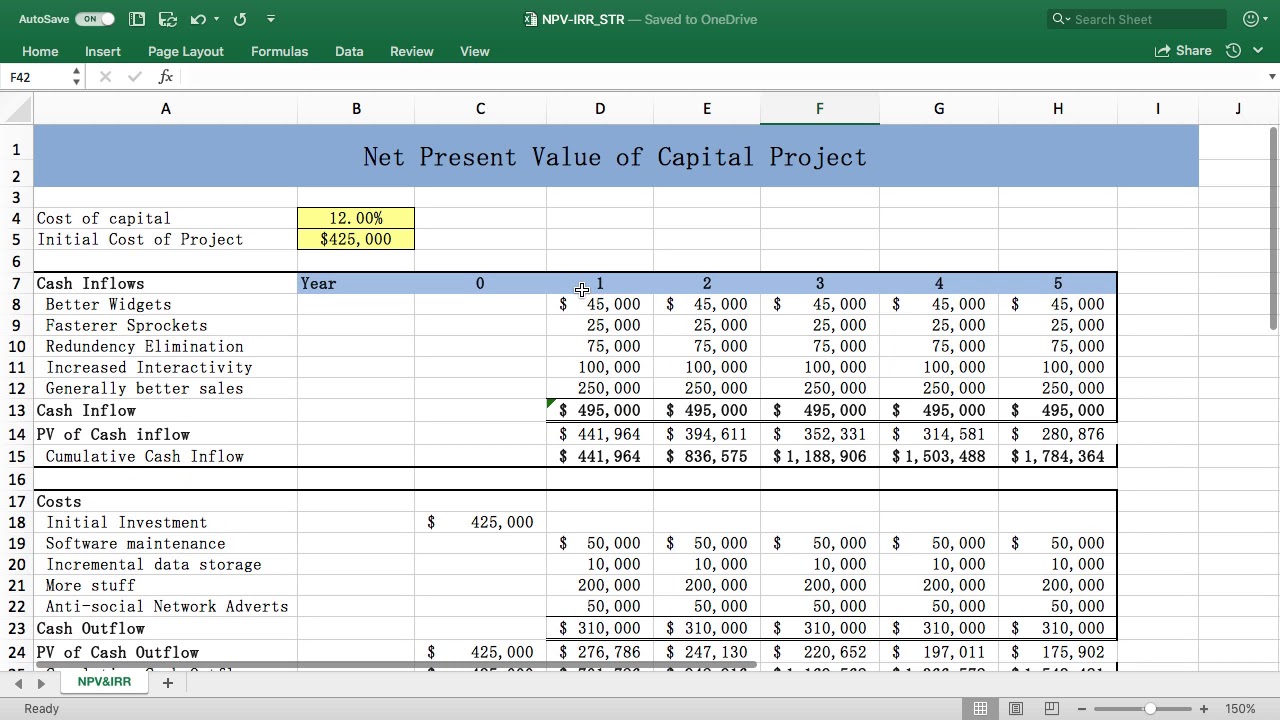

In practice, npv is widely used to. Creating a net present value spreadsheet to value your company (template here) one of the most widely used techniques in financial analysis is the net. How to calculate present value you can follow along with this tutorial in any version of excel for windows or mac, or any alternate.

Spreadsheets for finance: Npv = cf1 / (1 + r)^1 + cf2 / (1 + r)^2 + cf3 / (1 + r)^3. Z 1 = cash flow in time 1;

The net present value (npv) of an investment is the present value of its future cash inflows minus the present value of the cash outflows. The formula for net present value is: Npv takes a series of cash flows and discounts them back to the present value (i.e.

It is an excel function and a financial formula that takes rate value for inflow and outflow as input. It is used to determine the profitability you. This net present value template helps you calculate net present value given the discount rate and undiscounted cash flows.

For a single cash flow, present value (pv) is calculated with this formula: Where n is the number of cash flows, and i is the interest or discount rate. You can think of it as a special case of npv, where the.

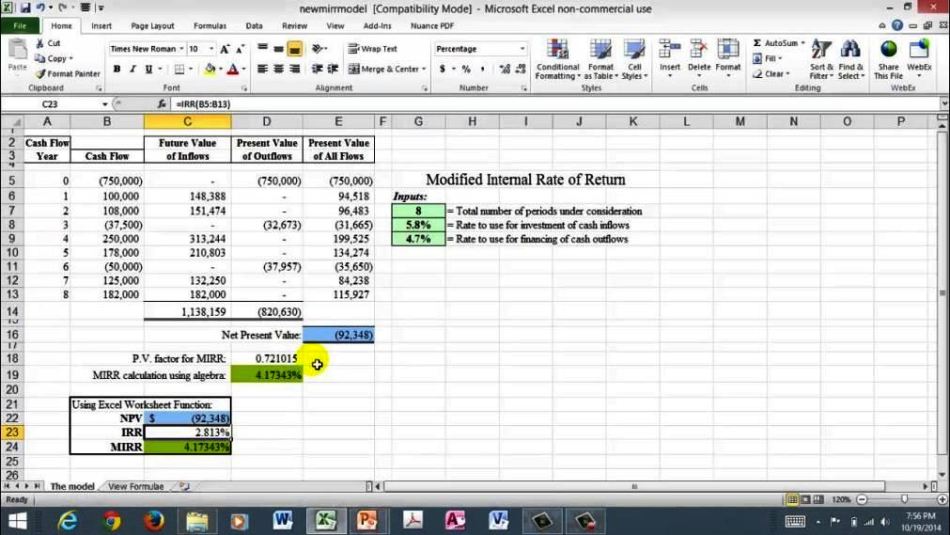

We discuss the npv formula in excel and how to use npv in excel, along with practical examples and downloadable excel. Irr is based on npv. The net present value (npv) is the difference between the present value (pv) of a future stream of cash inflows and outflows.

The npv formula is: Npv net present value | understanding the npv function the correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and. The downloadable spreadsheet template contains two worksheets.

Net present value (npv) is the value of all future. Cft = the cash flow in period t, r = the discount rate. + cfn / (1 + r)^n.

This article is a guide to npv function in excel. The formula for npv is: