Inspirating Tips About Income Expense Statement Excel

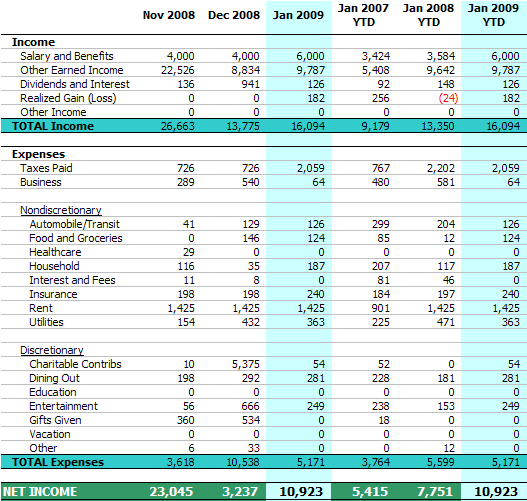

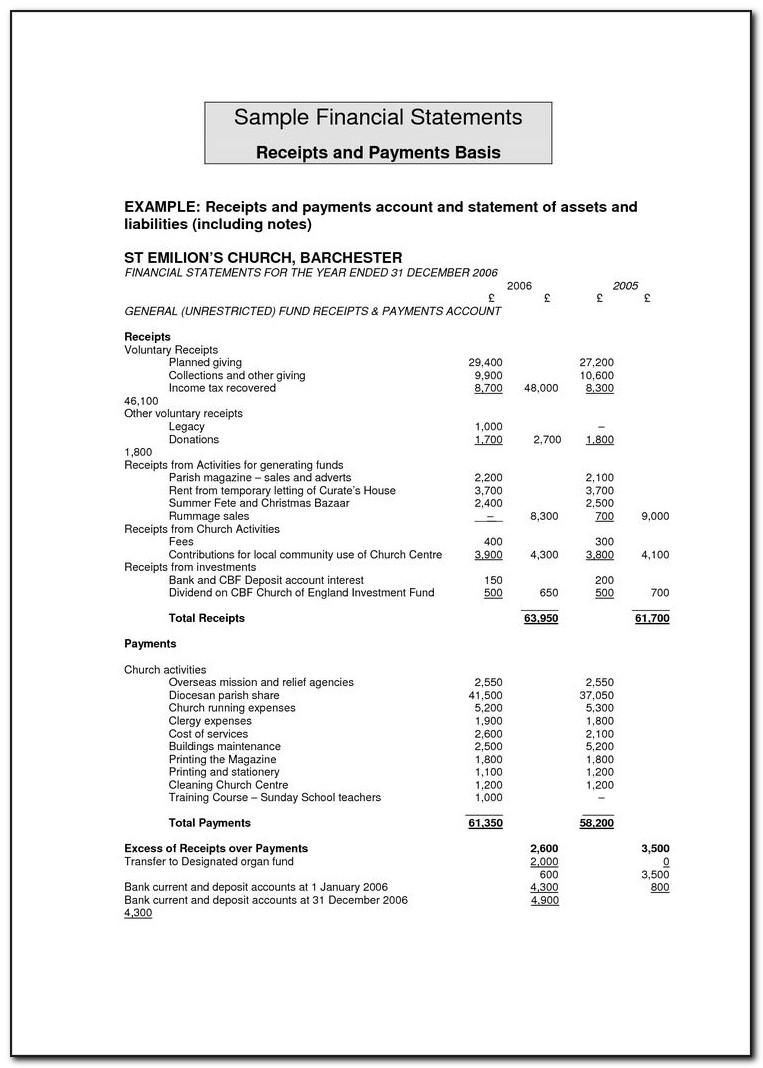

Understanding the key components of an income statement and performing analysis using excel can help you turn financial data into actionable insights.

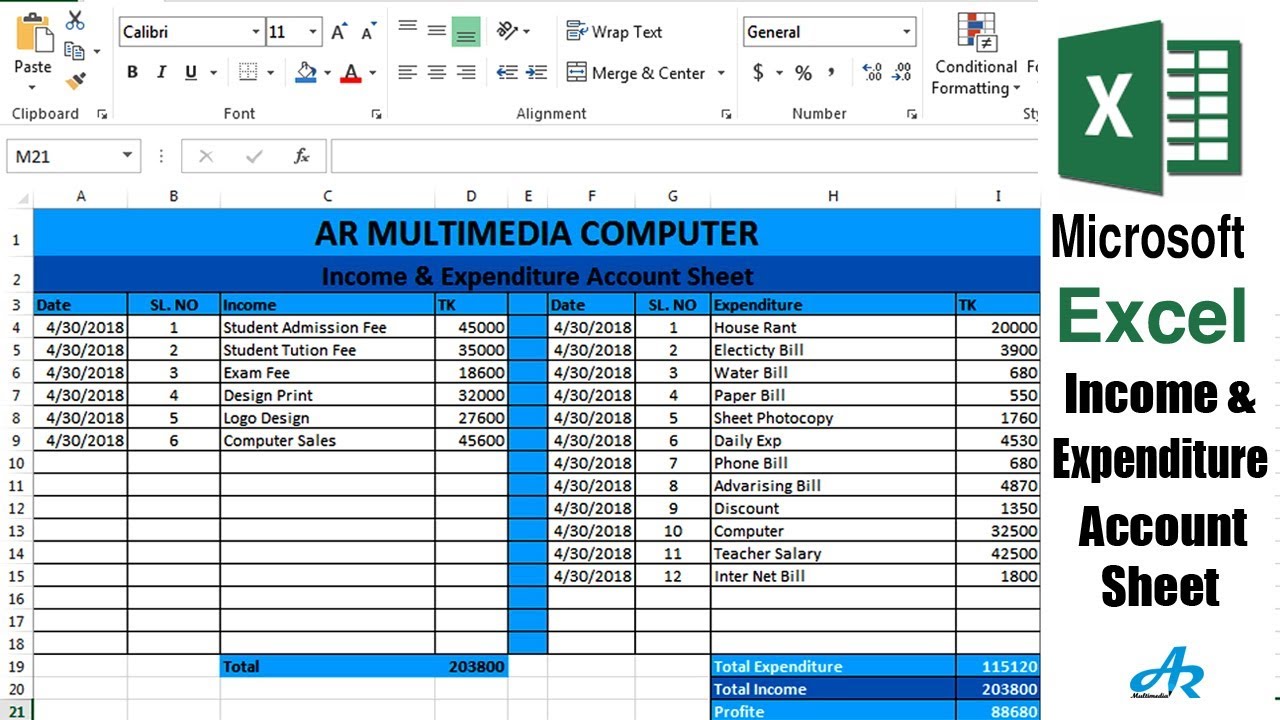

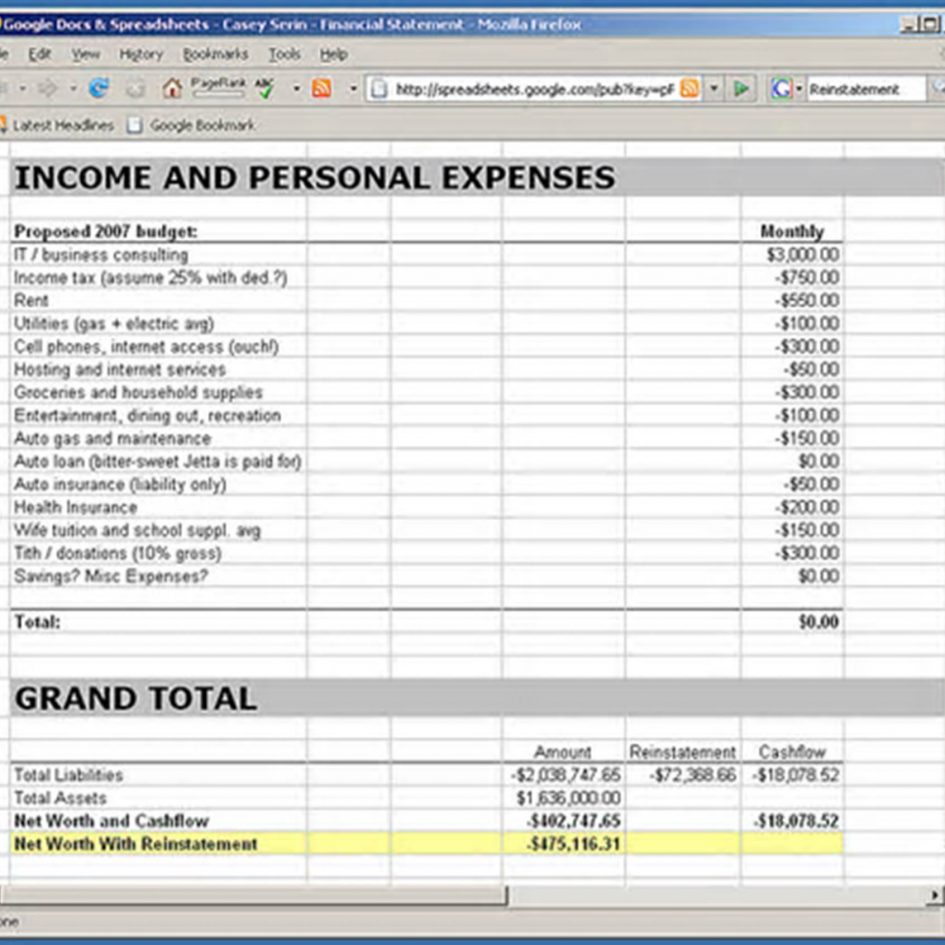

Income expense statement excel. To summarize, the key steps for making an income and expense statement in excel include organizing your data, creating a new worksheet, inputting your income and expenses, and using formulas to calculate totals and analyze. That way, you can see how you did your previous year and what you can improve. Stay on track for your personal and business goals by evaluating your income and expenses.

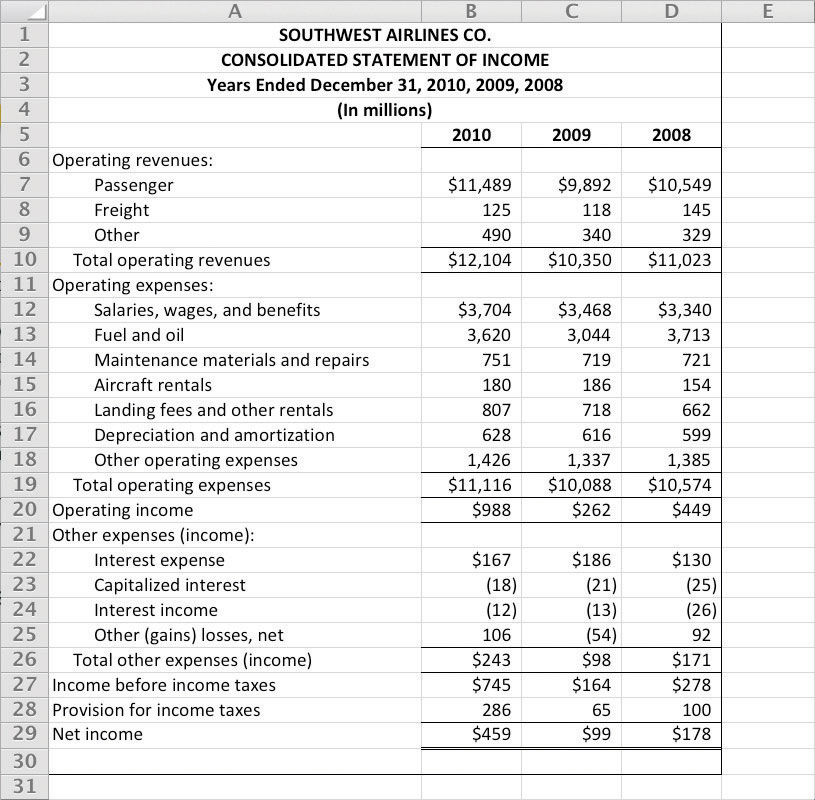

Moreover, an income statement gives managers and investors a clear overview of a company’s financial situation. It is similar to the “ income statement “. At first, you need to import your dataset if you don’t have any.

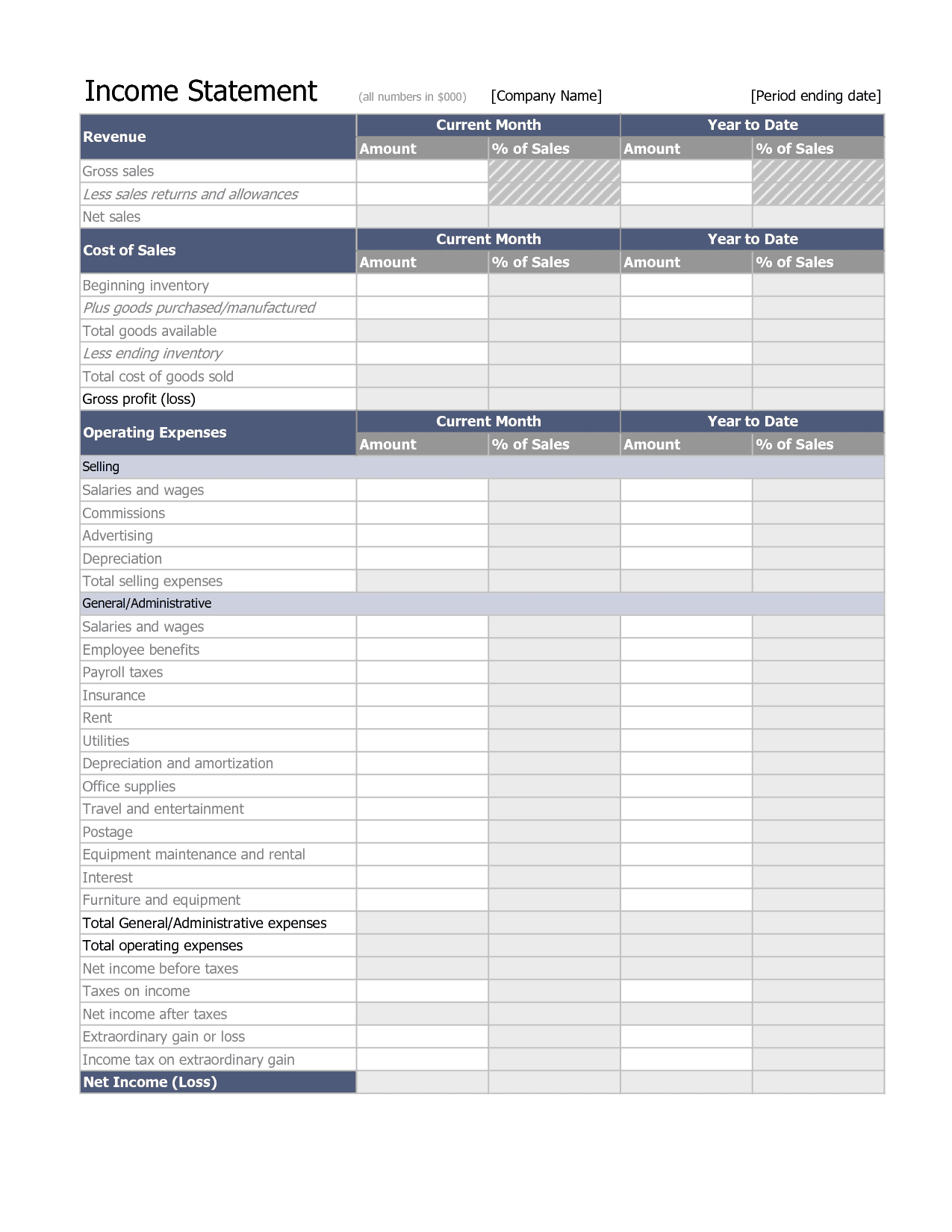

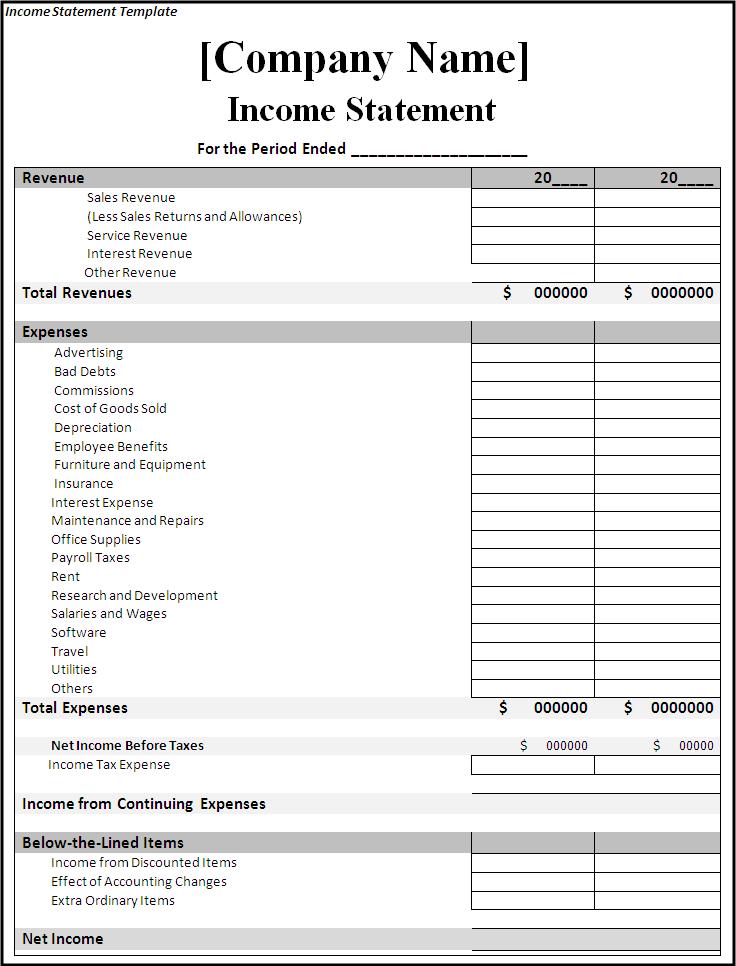

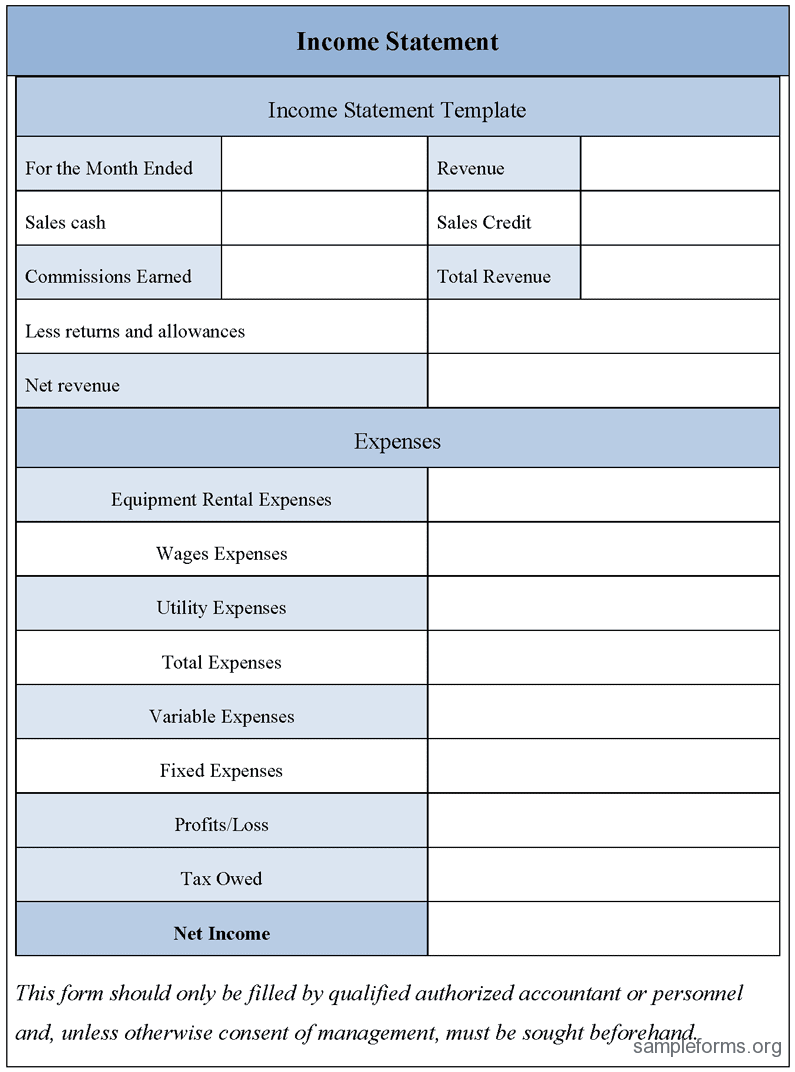

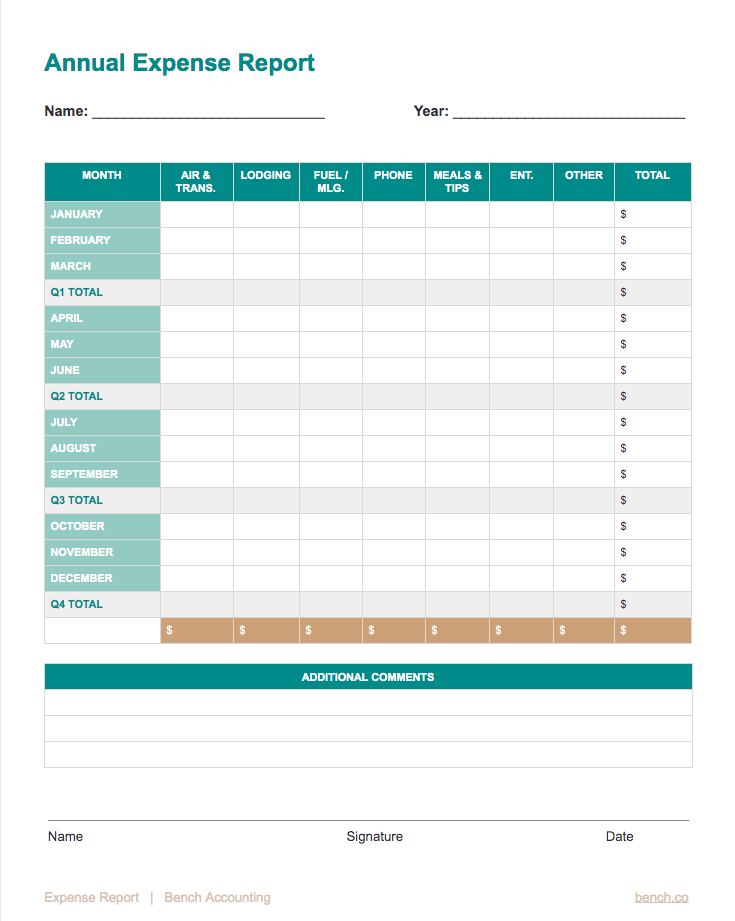

This excel income expense template is great for businesses who need to track and approve their. An income statement, also called an operating expenses statement, summarizes your company’s revenue and expenses over a specific period of time. By andy marker | december 13, 2022 we’ve gathered the top expense report templates for excel and included tips on how to use them.

The following are the best excel templates you can use to record the income statement of your enterprise. Download the free excel template now to advance your knowledge of financial modeling and accounting. Income statement template download an income statement template for microsoft excel® | updated 5/11/2020 an income statement or profit and loss statement is an essential financial statement where the key value reported is.

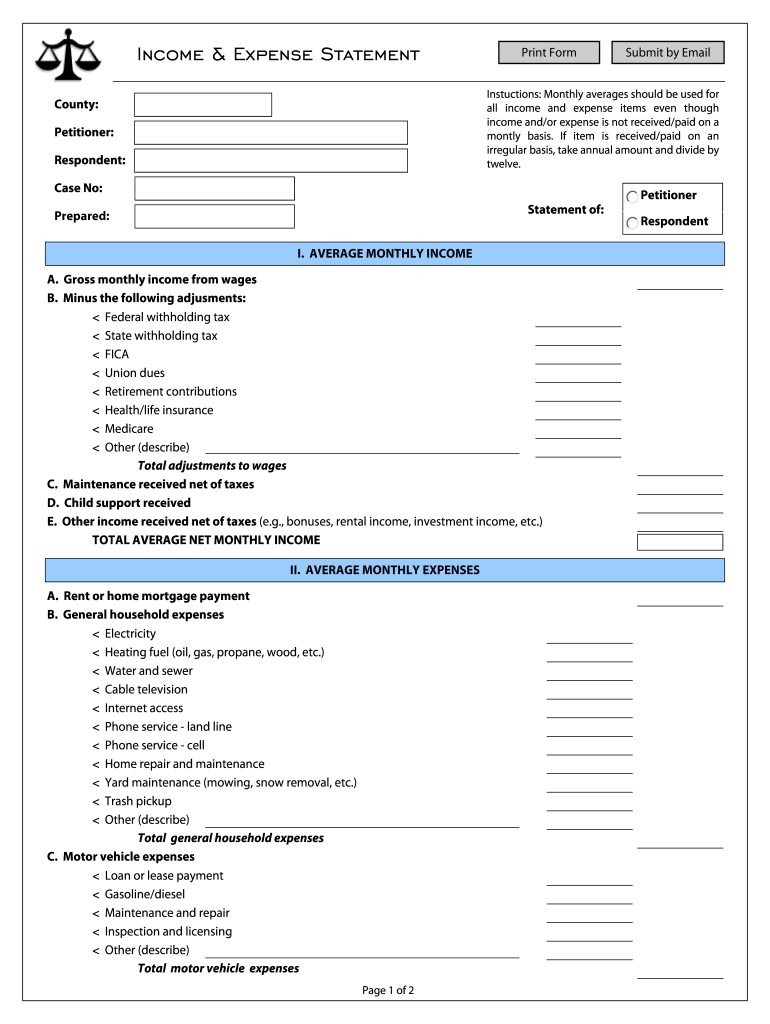

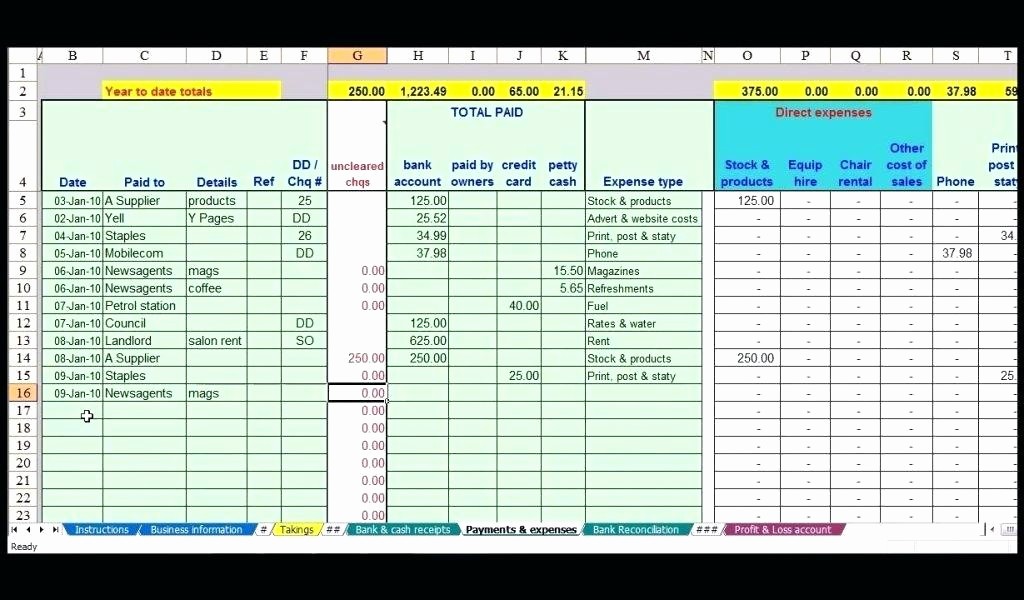

Creating an income and expense statement in excel is a powerful tool for managing personal or business finances. Track your costs in the customizable expenses column, and enter your revenue and expenses to determine your net income. If you are using it in excel on a smart phone, you'll find that it uses a lot of drop.

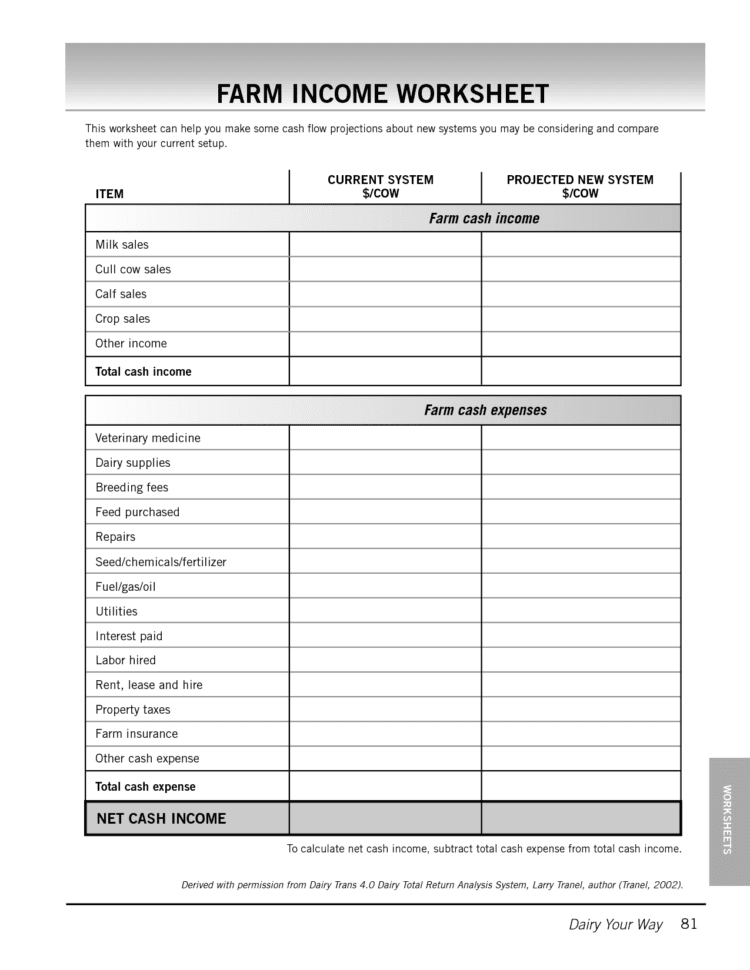

Choose your period most income statements are prepared annually. Use that information to create a budget. Record income & expense data at the very beginning, you have to record the income and expense data of.

In this example, we just want to store some key information about each expense. Select the cell directly beneath the total income label. Add up all your revenue from sales during the reporting period and deduct your returns and concessions.

Employee wages, utility bills, repair costs, advertising expenses, legal fees, and office supplies are all examples of revenue expenditures that companies must handle. Creating an expense and income spreadsheet can help you manage your personal finances. Businesses need to watch their revenue expenditure s closely because they affect cash flow and profits.

However, you can create quarterly (or even monthly) income statements. Calculate how much revenue your business is making, how much expenses you're spending, and how much profit you're generating on a monthly and annual basis. Using the income and expense worksheet i tried to make the spreadsheet as easy to use as possible.

This is particularly useful if your business is new or if you're changing strategies. This spreadsheet is designed for personal finance and printable benefits and it is also modified as an editable worksheet. Input your costs and income, and any difference is calculated automatically so you can avoid shortfalls or make plans for any projected surpluses.