Divine Info About Company Car Allowance Policy Template

It categorizes expenses into those paid directly by the company and.

Company car allowance policy template. Car allowance mileage rate policy for employees. In its simplest form, the answer is:. In this guide, we’ll give you all the knowledge needed to take advantage of car allowances in relation to company cars for business use.

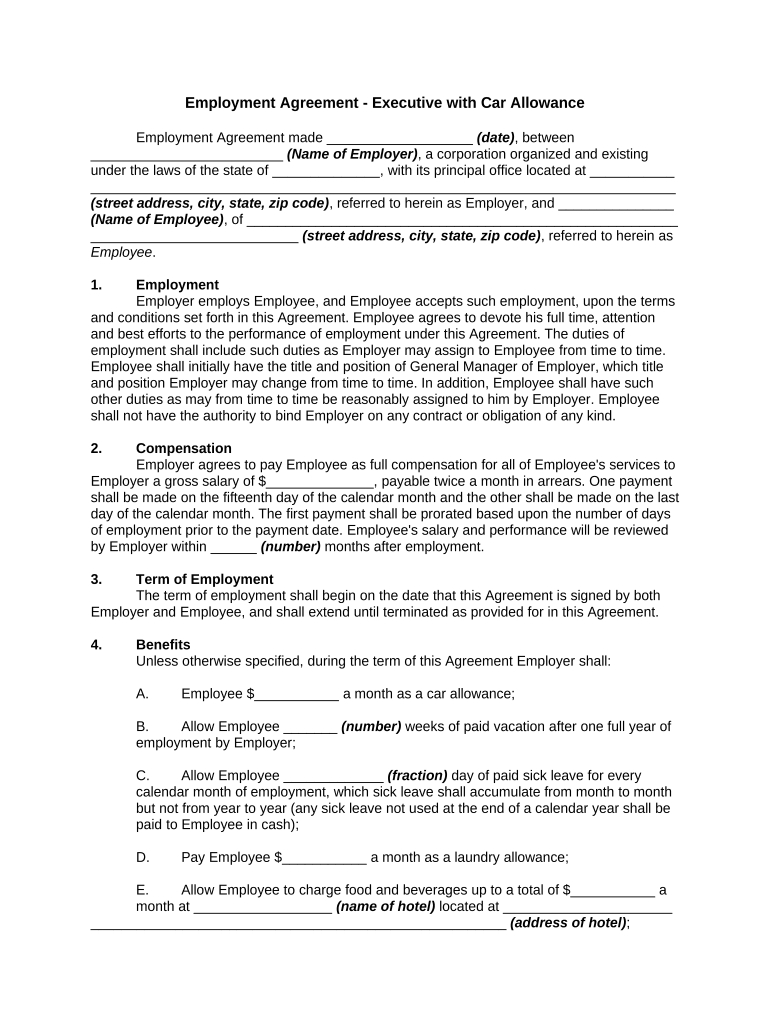

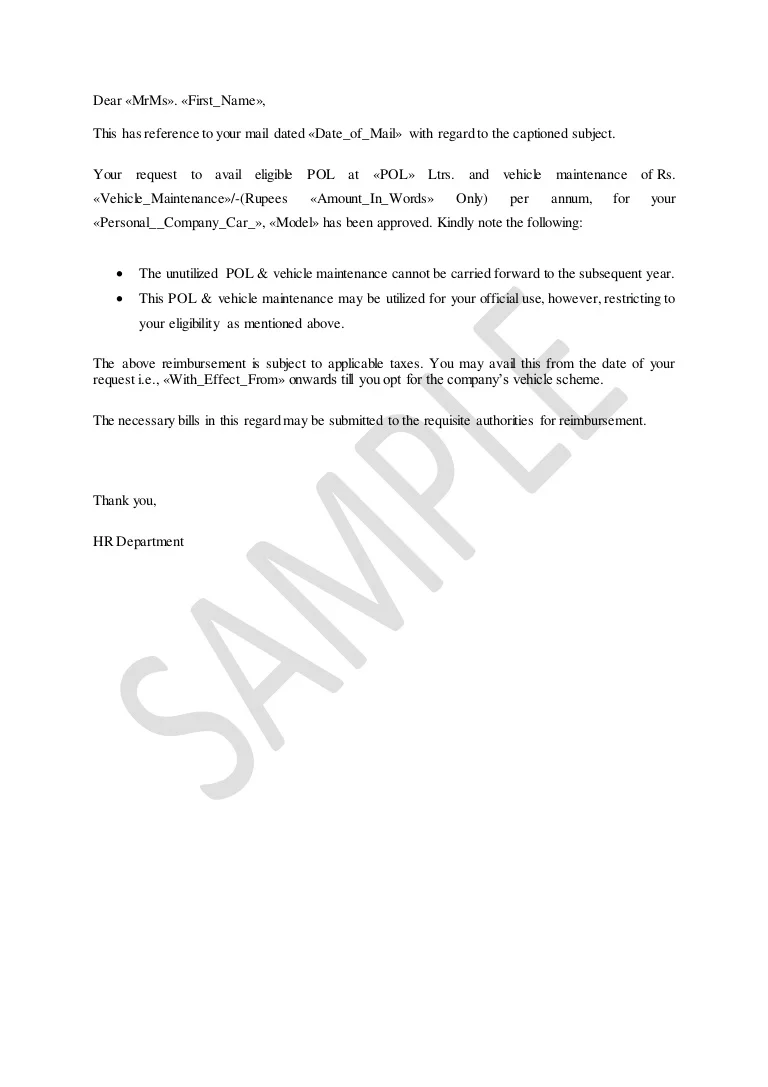

For some, having a company vehicle is a vital part of their role. 1this document outlines the options, allowances and choice of cars available to employees who are eligible to receive a [organization] car or a monthly car allowance and the. The company shall provide executive with a company car corresponding to a value of one thousand five hundred u.s.

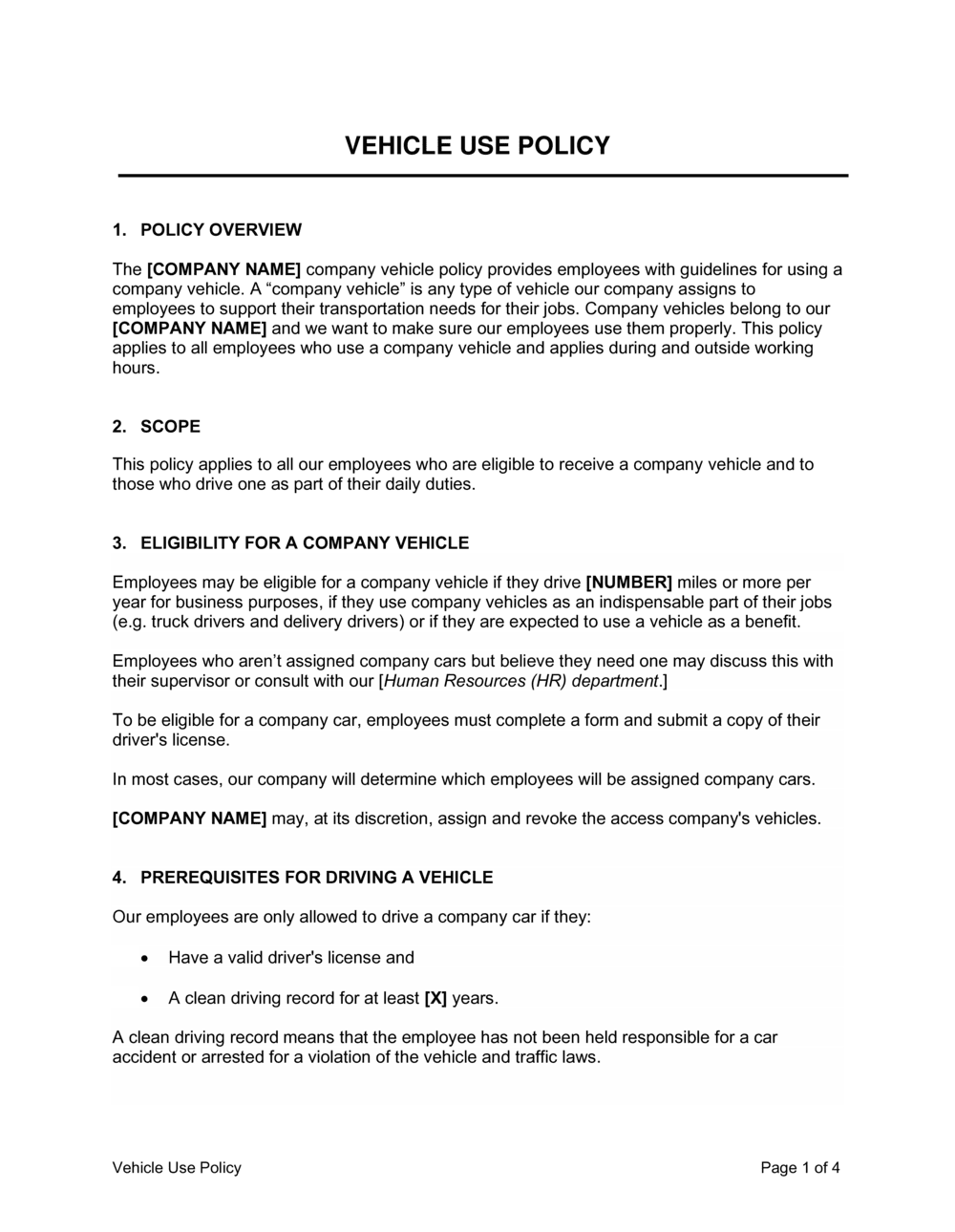

A car allowance policy can be useful when a car is required for business use and, in a way, relieves the business of a responsibility towards the vehicle. January 4, 2024 12:33 pm why is it important to review your car allowance policy? One “company car” is any.

| 3 min read one primary concern among small business owners is whether or not a car allowance will be a suitable model for their company. The reimbursement to the employee for the operation of other than company owned vehicles on company business includes the allowance for the expense of automobile. Our company car policy description our guidelines for using firm cars.

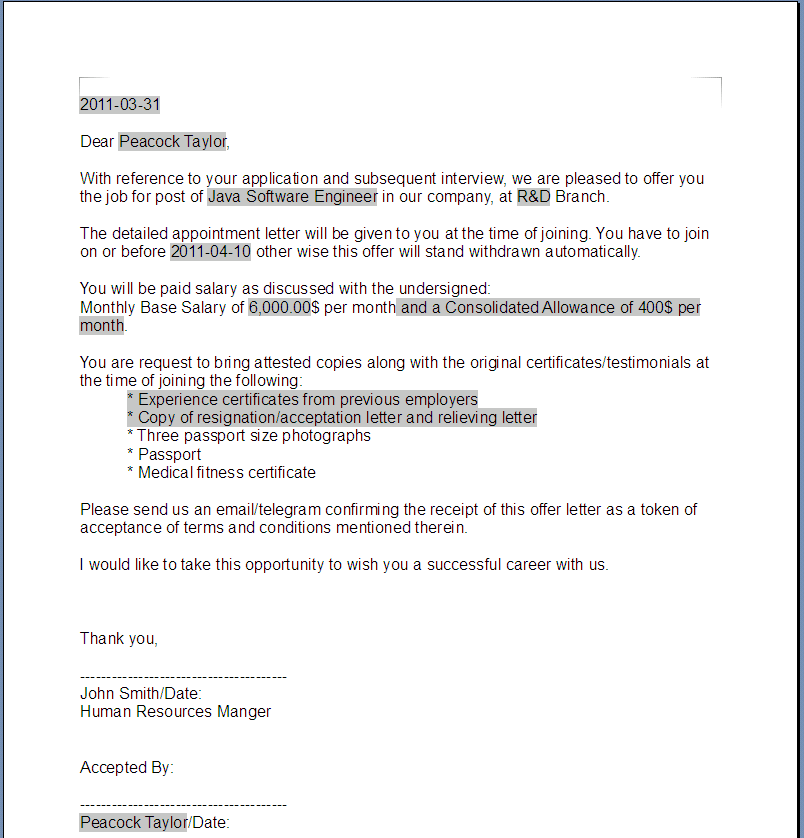

Company vehicle usage policy template download 108 kb company vehicle usage policy samples company car usage policy this section addresses only those. A company vehicle policy, or a company car policy, is an agreement between the company and its employees that provides a guideline for using company cars. A company car policy, or agreement, is a contract that outlines how employees can use a company car.

What is a car allowance and how does it. An employer’s guide for 2024 andjelka prvulovic last update on: What is a car allowance and how does it.

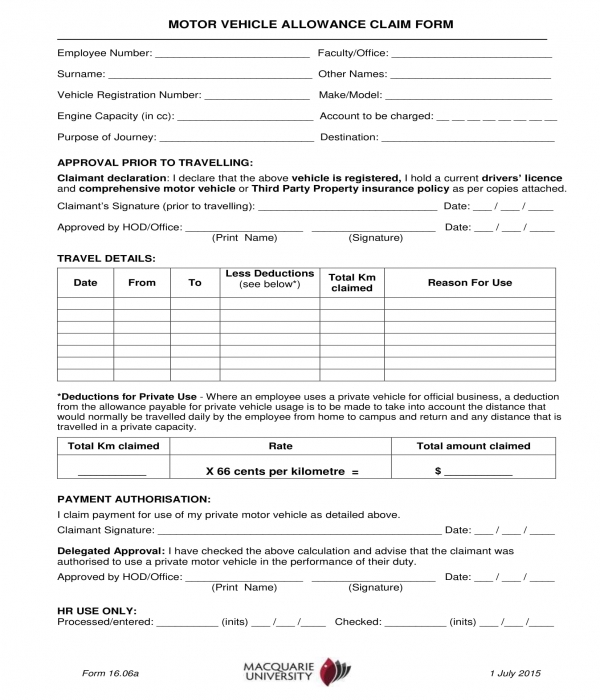

The irs will only allow people to use the allowance up to a certain amount, which is 0.655 cents per mile for. A car allowance policy is when the employee provides a flat rate (often per month) to compensate employees for using their vehicles. However, providing an employee with a vehicle can present some complications.

As long as you follow the sections mentioned above, you should have no issues. Our company car policy describes our guidelines for using company cars. Download our template to ensure its proper use.

In this guide, we’ll give you all the knowledge needed to take advantage of car allowances in relation to company cars for business use. Dollars ($1,500) per month, in accordance with the. A “company car” is any type of vehicle our company.

Get {gvtemplatenumbers} templates to start, plan, organize, manage, finance and grow. Policy 1.1 this policy outlines the company’s arrangements for the provision of company cars and car allowances to eligible. Here are our top ten reasons to contract out the management of your company's car allowance or business reimbursement policy: